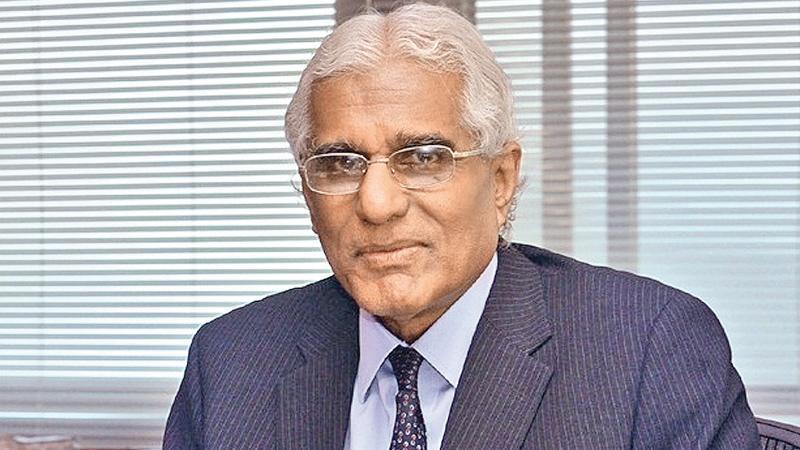

Economic growth will reach around 5.5 percent by the end of this year given the optimism of economic growth in the US and China materialising along with the drought in the country coming to an early end, Central Bank Governor Dr. Indrajit Coomaraswamy told the media at the monetary policy review last week.

The economy recorded a 5.3 percent year-on-year growth in the fourth quarter of 2016, following an upwardly revised 4.6 percent expansion in the previous period.

He said, however, there is plenty of downside risks to the economy such as external uncertainty and the adverse weather in the country that could negatively influence the growth targets envisaged for this year. Economic analysts said with burgeoning government debt running into several billion and a meager foreign reserve base of around USD 5.5 billion to service imports of few months the economic growth rate will be lower than what has been projected by the Central Bank.

“We expect the reserve base to reach around USD 7.5 billion by the end of this year. The current base is totally inadequate by any measure. We are hopeful that the deal with China on the Hambantota port will come through and with the sovereign bonds and syndicated loan the foreign reserve base will be at a satisfactory level,” the governor said.

However, he noted that the country needs right now non-debt creating funds to pay off some debt and manage liabilities.

The non-debt creating funds such as the Hambantota port is vital to have more inflows to the country.

He said the third tranche of the IMF Extended Fund Facility is expected by end May or June after the review process which takes around a month by the IMF is complete. Responding to questions whether the Central Bank increased its policy rates recently as a condition of the IMF the governor said interest rates were increased as a forward looking measure laid out in the road map of the Central Bank .

“Policy rates were increases as because the growth is not robust enough and the uptick in inflation due to supply disruption, tax adjustments and strong base effects. Besides the Current Account deficit was worst that we expected and the impact of drought was severe,” Dr. Coomaraswamy said.

He said on the monetary side we are not happy with the developments. Credit growth has not slowed down as expected. We had to adjust rates in keeping with the US Federal Reserves rate increase by 25 basis points .

Private sector credit growth decelerated to 20.9 percent in January this year compared to 21.9 percent as at end last year. However borad money growth has been high at 17.7 percent in January this year despite decelerating from 18.4 percent in December 2016.