The recent positive revision to Sri Lanka’s outlook by Standard and Poor’s (S&P) will make it easier and cheaper for Sri Lanka to raise debt while helping the country secure longer tenures on funding lines, the Central Bank Governor said last week.

Standard and Poor’s on Monday lifted the outlook on Sri Lanka’s ‘B+’ rating to ‘stable’ from ‘negative’ based on the assessment that strengthening of Sri Lanka’s institutions and governance practices is on a more sustainable footing.

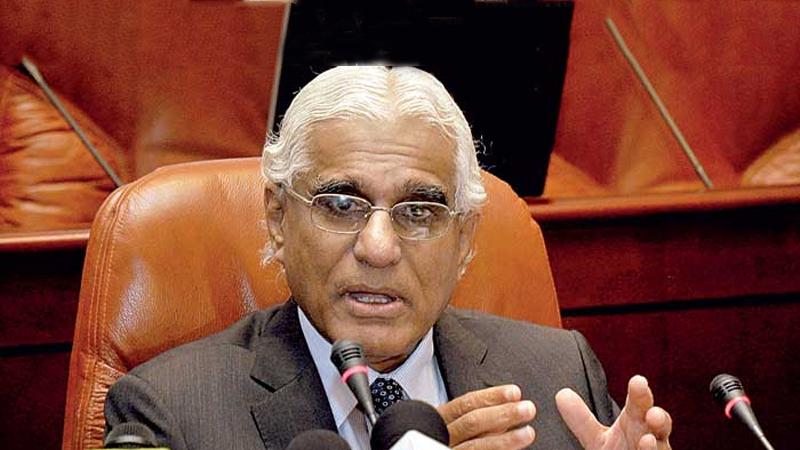

“This is a timely boost for Sri Lanka given that we are going into the market next year to raise a large amount of money to partly finance the budget deficit, as well as to raise money for liability management, to address the bunching of external debt,” Central Bank Governor, Dr. Indrajit Coomaraswamy told the Sunday Observer.

However, the Governor said the quantum of planned borrowing will only be known after Budget 2018 is passed in Parliament and the country’s funding needs are clearly spelt out.

“We won’t borrow for less than 10 years but we will have to actually see what the market is like when we go out to raise money,” the Governor said.

Amid the potential cheaper cost of capital from overseas, Dr. Coomaraswamy said caution will be exercised when raising funds since Sri Lanka already has a large debt stock.

Presenting Budget 2018 in Parliament, Finance Minister Mangala Samaraweera had disclosed that Sri Lanka’s debt repayment for 2018 amounted to Rs. 1,970 billion.

“Since there is a budget deficit and if we finance all of it domestically, the domestic interest rates will go sky high.

We will raise part of it domestically and part of it from abroad so that we can contain the pressure on domestic interest rates,” the Governor explained.

On the other hand, the Governor highlighted that the rating upgrade will boost confidence among potential foreign investors, particularly institutional investors while it will be a shot-in-the-arm for Sri Lankan corporates looking to raise funds overseas.

Budget 2018 had proposed to allow Sri Lanka’s major State banks, the Bank of Ceylon and the People’s Bank to raise debt and equity capital overseas. Previously, the BoC and the National Savings Bank had accessed the international markets to raise capital.

S&P said the Government has maintained its reform momentum, as shown by the passage of the Inland Revenue Act and expects the Government to implement additional measures to smooth the approaching debt redemption spike in 2019.

“A higher rating is unlikely in the next 12 months, but upward pressure could coalesce if Sri Lanka’s external and fiscal indicators show dramatic improvement. Upside pressure could also materialize if it concludes that there has been a substantive improvement in Sri Lanka’s institutional settings, including a continued strengthening of monetary policy credibility and independence at the Central Bank,” S & P said in a statement early last week.