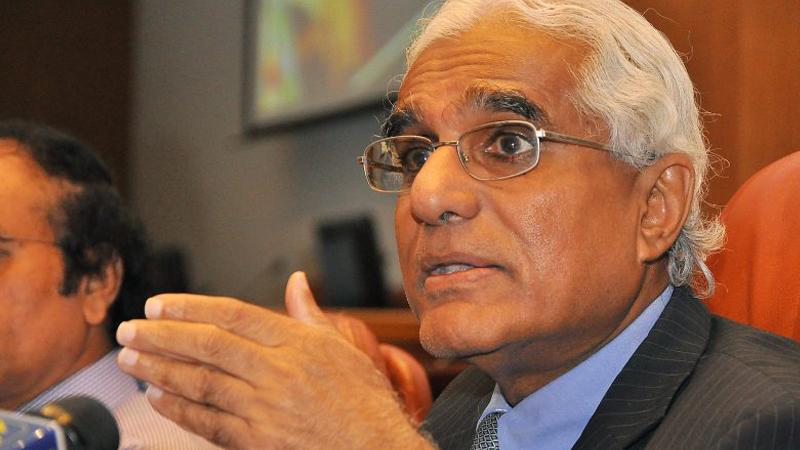

Central Bank (CB) Governor Dr. Indrajit Coomaraswamy told the media last Friday that the Central Bank does not anticipate inflation to go up above the 4-6 % range this year and added that inflation would trend down in the second half of the year.

Speaking at the third monetary policy review held last Friday at the Central Bank, Dr. Coomaraswamy said inflation expectation will continue to be anchored.

Inflation has been stabilised at a single mid digit level so far down the year.

However, the Central Bank hinted that there would be a temporary uptick in inflation in the coming months due to a direct and indirect impact of the upward price revision in fuel, gas and milk powder. The prices of fuel was revised upwards from last Thursday and prior to it the price of a 12kg cylinder of gas was raised by Rs. 245 and the prices of the I kg and 400g pack of milk powder was raised by Rs 50 and Rs. 20.

The price of fuel in the global market is projected to hit US$ 80 per barrel shortly exerting pressure on commodity prices in the domestic market. However, the Central Bank is of the view that even with the spike in global oil prices in the short term inflation would hover around the single mid digit level.

“Even at global oil prices reaching $ 80 per barrel inflation will be around the 4-6% levels,” the Governor said.

However, with regard to the economic growth rate in the first quarter this year the Governor was not pleased as it is below the potential growth rate.

“Of course there is an output gap with growth in the first quarter not at its potential growth rate,” the Governor said.

The economic growth rate in the first quarter this year is 3.7 % and according to the bank the economy is expected to record a moderate growth this year due to improvement in the global economic activity and domestic conditions.

The bank stated that the exchange rate faces some pressure but is expected to stabilise in the coming months. The rupee had depreciated by 3.2 % against the dollar up to May 11 this year. The depreciation of the currency was high during April and May due to less inflow of foreign currency in to the market from exporters during the festive season. The bank noted that the depreciation of the local currency was low compared to the Philippine peso at 3.9 %, Indian rupee % and Australian dollar by 4.5 %. Imports continued its upward trend with higher volumes of gold and vehicles in April. However, exporters, according to the Bank, maintained a positive momentum during the year.

The bank cleared certain misconceptions regarding the depreciation of the currency placing the advantages and disadvantages when the currency is devalued.

The advantages are an increase in revenue from import tax in rupee terms and enhancing local currency for foreign currency borrowing of the Government while the negative implications are the increase in foreign currency dent service payment of the Government in rupee terms and the growth in expenditure on imports.