Pan Asia Banking Corporation PLC, one of the fast growing Sri Lankan commercial banks, reported its best ever profit for a nine month stretch, anchored by solid growth in new loans, and prudent margin and asset-liability management.

For the nine months ended in September 30, 2018, the bank reported a profit after tax of Rs.1,080 million, up by 18 % from the same period in 2017. The net interest income grew by a strong 21% on a year-on-year (yoy), basis to Rs.4.43 billion, supported by better margins recorded despite the rising cost of funds.

The net interest margin increased to 4.01% during this period, from 3.61% in December 2017 as the bank continuously reviewed the pricing of its asset and liability portfolios. Meanwhile for the quarter ended in September 30, 2018 (3Q’18), the bank reported earnings of Rs.260.7 million on a net interest income of Rs.1.61 billion compared to Rs.301.3 million profit and Rs.1.29 billion net interest income reported in the same quarter last year. Higher provisions for possible bad loans during both the quarter and the nine month period, undermined the performance of the bank.

The better top line performance during the nine months is also a reflection of relatively strong growth in the loan book of over Rs. 15 billion which translates in to growth of 13.5% in the loan book. The loan growth propelled the bank’s asset base to Rs.156.4 billion by the end of September, an increase of 13%.

‘We recorded quite a solid growth in our loan book during the first nine months of 2018 amid the many headwinds we faced during this period.

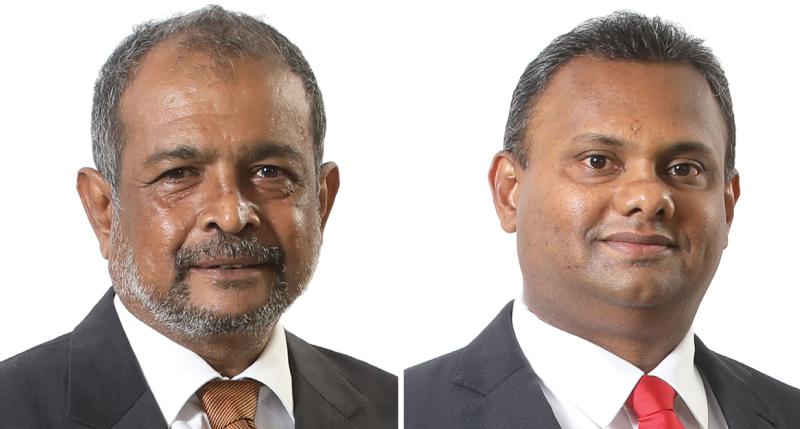

I consider this achievement noteworthy because we recorded it amid a moderation in sector loan growth and rising non-performing loans’, said Nimal Tillekeratne, Pan Asia Bank’s Director/ Chief Executive Officer.

Meanwhile despite the rising non-performing loans in the industry, Pan Asia Bank managed its gross non-performing ratio at 4.83% by the end of September, from 4.36% in December 2017.

The bank also increased its deposit base by Rs.9.1 billion.

During this period the bank launched ‘Rising FD’ a two year fixed deposit product, where the interest rates can only go up during the deposit period at six month intervals This unique product is the only one of its kind in the market as this term deposit allows a deposit holder to hedge his or her interest rate risk at a time of rising interest rates and inflation.

By the end of the first nine months, the bank’s capital adequacy levels stayed above their regulatory minimums stipulated under BASEL III accord, while the Bank’s tier I and tier II capital ratios stood at 10.65% and 12.11% respectively. Higher capital requirements under the BASEL III accord, come in to full effect from the beginning of 2019.