The Asian Development Bank (ADB), the Government and the Regional Development Bank (RDB) signed loan and guarantee agreements to further assist Sri Lanka to provide affordable and accessible credit to rural micro, small, and medium-sized enterprises (MSMEs) in the country.

The ADB will provide a $50 million loan with sovereign guarantee from the Government under the financial agreements.

“MSMEs have high growth potential, create more jobs, and over time, potentially increase the tax base at a quicker pace than larger enterprises,” said ADB Country Director of the Sri Lanka Resident Mission, Sri Widowati. “Because of their distribution over the whole country, they also help reduce regional inequalities”.

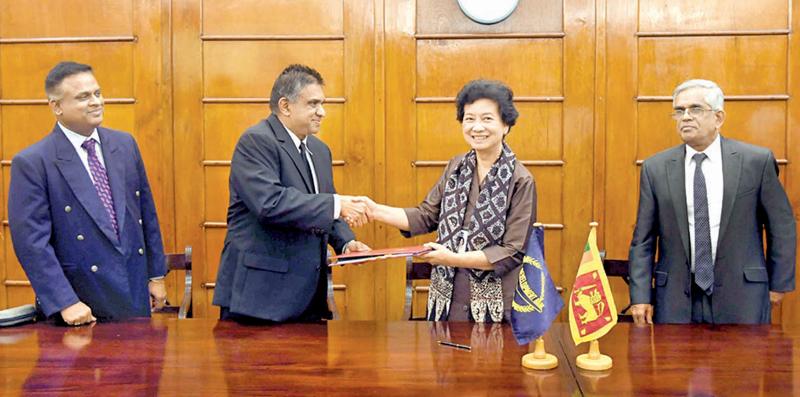

Widowati signed the Guarantee Agreement on behalf of the ADB while Secretary to the Treasury, Dr. R.H.S. Samaratunga signed for the Government. A loan agreement was also signed between the ADB and the RDB.

With only approximately 30% of Sri Lankan firms having sufficient access to bank loans and other capital, limited access to finance is a key barrier facing entrepreneurs in Sri Lanka.

These constraints are even greater for micro and small enterprises led by women or located in rural areas.

The project will not only directly fund $50 million of long-term financing through RDB to micro and small enterprises outside of Colombo, including women-led businesses, but will also be structured to provide RDB the additional regulatory capital that would leverage up to an additional $533 million of lending to MSMEs.

Implemented through the RDB, a state-owned bank whose mission is to strengthen the living standards of the rural population by providing affordable and accessible credit facilities; the bank’s unique business model and wider branch network across rural areas can effectively cater to rural small and micro enterprises that are mostly missed out by the private sector commercial banks.

Integral to the project is a technical assistance (TA) grant of $1 million from the Japan Fund for Poverty Reduction, financed by the Government of Japan, to support RDB’s sustainable long-term growth.

The TA will upgrade RDB’s business model and directly promote gender mainstreaming through training to about 500 women entrepreneurs.