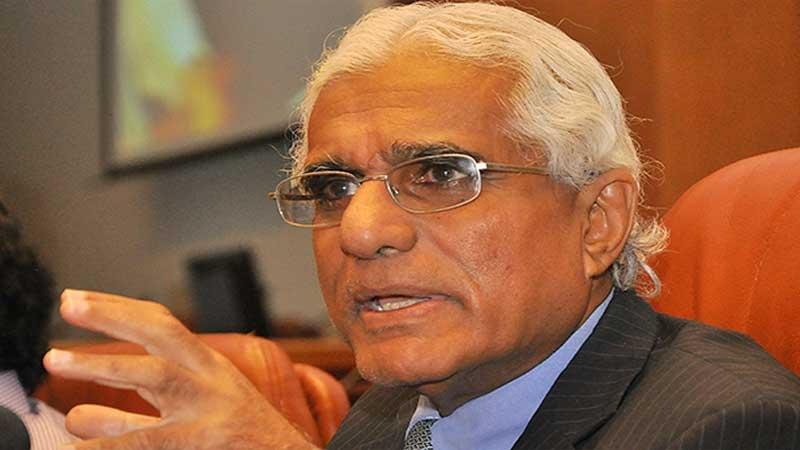

The new Monetary Law Act that will come into force shortly has boosted investor confidence which was seen in the over-subscription of this year’s March and June dollar denominated bond issuance, said Central Bank Governor Dr. Indrajit Coomaraswamy at the 69th anniversary Oration of the Central Bank this week.

He said US$ 3.4 billion dollar denominated bonds were issued at the last quarter of 2018 which was successful due to the new legislation that is aimed at giving greater independence to the Central Bank.

“We were able to issue two dollar bonds after the April 21 because of the legislation that is in the making. We see clear macroeconomic framework in place,” the Governor said.

The Central Bank issued a 2.4 billion dollar bond in March and returned to the US dollar bond market after the Easter attacks in June to raise US$ 2 billion. The two issuances US$500 million five-year bonds and the US$ 1.5 billion 10-year bonds issued at a yield rate of 6.35 percent and 7.55 percent will mature in 2024 and 2030.

The new Monetary Law Act will prevent the Central Bank from printing money for the government to address budget deficit, grant more responsibility, increase transparency and ensure greater accountability of the bank.

“The MAL is landmark pieces of legislation that will help the country get over the twin deficits,” the Governor said. However, the MAL is also considered a move to change the powers vested in the Central Bank to issue currency notes and amend the 1949 Monetary Act.

President Maithripala Sirisena has insisted that prior to any amendment to the monetary law is made it has to go through a broader stakeholder consultation. The amendment of the 70-year law has been a long felt need to upgrade the monetary policy formulation process in keeping with international best practices and introduce a vibrant macroprudential policy framework to uphold the stability of the financial system.

The new law also aims at flexible inflation targeting which the regulator has been considering for some time. The Central Bank conducts monetary policy within an enhanced monetary policy framework with features of both monetary targeting and flexible inflation targeting (FIT). Under this enhanced monetary policy framework, the Central Bank attempts to stabilise inflation in mid-single digits over the medium term, while supporting the growth momentum of the economy and flexibility in exchange rate management. In terms of operational aspects of this framework, the Central Bank uses its policy instruments to guide short term interest rates, particularly the average weighted call money rate (AWCMR) as the operating target.