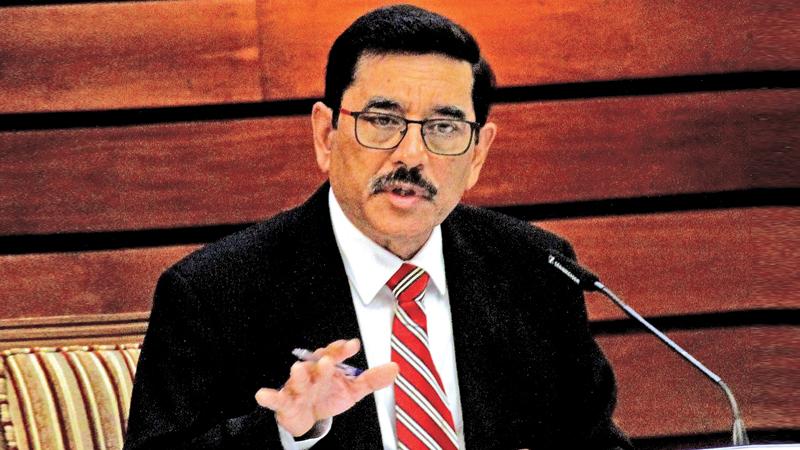

Discussions with the IMF will go on and hopefully an agreement for a support program will be reached within around three months as there is some improvement with regard to political stability in the country, Central Bank Governor Dr. Nandalal Weerasinghe told journalists at the monetary policy stance media briefing on Thursday.

Responding to the statement by former Finance Minister Ali Sabry who said reaching some form of an agreement with the global lender would take at least six months the Governor said the statement of the former minister had been misunderstood and added that following preliminary discussions and thereafter approval from the IMF board an agreement could be reached within around three months.

It is not a one-sided matter. Both parties have to agree, the Governor said.

When asked about his stance on remaining or quitting his post the Governor said there is a marked improvement with regard to political stability today from a state when there was no prime minister, a Cabinet but rather violence over a week ago when I said I would step down if the stalemate continues for a couple of weeks.

The financial sector regulator hopes to see a gradual reduction in foreign currency circulation outside the formal banking system following moves to reduce the possession of foreign currency from USD 15,000 to USD 10,000 and the duration of being in possession to two weeks after which it has to be deposited in a foreign currency account under the Foreign Exchange Act.

Foreign currency had been withheld due to large black market premiums offered outside the formal channel.

“We have requested all foreign currency holdings to be slashed to USD 10,000 with proof of how it had been acquired and a two-week grace period to bring them to the banking system. Fines will be imposed for non compliance,” the Governor said.

However, according to the Central Bank the economy is expected to contract sharply this year due to the ongoing supply shortages, energy related issues and social tensions, as reflected by several leading indicators.

Demand management policies of the Central Bank and anticipated fiscal consolidation measures are also expected to keep aggregate demand subdued during the year.

Besides, the country has racked up nearly USD 51 billion in foreign debt of which USD 7 bn has to be settled this year.

Global economic growth is also expected to moderate in response to the tightening of monetary policy by the Central Banks globally to counter inflationary pressures along with the spillover effects of the geopolitical tensions in Eastern Europe.

The bank said policy measures implemented by the Central Bank need to be reinforced by adequate and timely policy adjustments by the Government to prevent further deterioration of economic conditions and complement the efforts of the Central Bank implemented thus far, urgent measures are required to restore greater political stability through consensus governance and social harmony.

Swift policy actions are required to strengthen the fiscal performance that would help avoid excessive reliance on monetary financing and maintain fiscal sustainability over the medium term. Expeditious and transparent revision of tariffs in the energy sector remains a priority to strengthen the financial position of energy-related state owned business enterprises, while improving the efficiency of social welfare programs to support the vulnerable groups of society impacted by the unprecedented economic circumstances.

The Central Bank decided to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank at the current levels of 13.50 percent and 14.50 percent.