The President has instructed the State apparatus to reduce its expenditure in light of the current crisis as the Government attempts to increase its revenue through taxation. Here representatives for four political parties presented their views on four common questions asked on State revenue, expenditure and foreign debt.

Q :

1. If your party was currently in power what action would it take to increase State revenue?

2. What are your party’s solutions to cut unnecessary expenditures and reduce the burden on the State sector?

3. What is your party’s stance on servicing debt, obtaining foreign loans and IMF support?

4. The President has proposed the reduction of local Government councillors from 8000 to 4000 to cut costs. Your party’s stance on this?

* Taxes must be levied in a manner that is bearable to the public

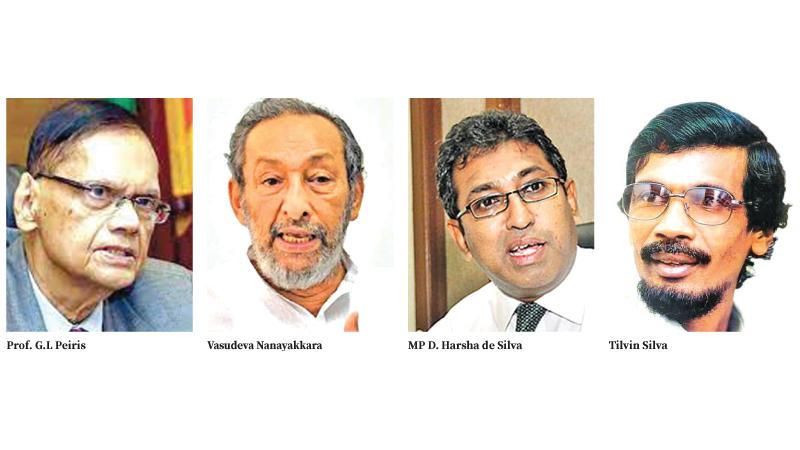

Independent MP, Freedom People’s Congress Prof. G.L Peiris

1. Taxes must be levied in a manner that is bearable. A person earning Rs. 100 000 must pay between 6 - 36 percent in taxes. Due to bank interest rates people aren’t able to make ends meet even by doing business. No one can pay 35 percent in interest and make profits. Businesses are shutting down because of the increased electricity tariff. The economy is in a state of contraction. If we come to power we will improve the processes in the BOI to attract more investments. We will eradicate corruption, improve services for immigrant workers and develop tourism. We will reduce the expenditure on Ministers.

2. We are against the sale of profit-making ventures. They must be restructured. The country is not financially able to maintain 30 Cabinet Ministers and 40 deputies. They must be reduced. Expenses of the President and Prime Minister must also be cut down. Their expenses cause anger among the people and lead to dissent.

3. Though we must seek IMF support we must be more stoic about our needs. Bangladesh approached the IMF only after us but they reached an agreement before us. IMF proposals must be flexible. We do not have to adhere to them exactly as presented. We must reduce expenses to increase revenue but in a manner that is bearable to the people. We must seek a grace period to repay our debt and increase profits during that time.

4. This is a good proposal. The only issue is it’s being presented just ahead of Local Government polls. Therefore, there is a question of its sincerity. The Government has made many attempts to delay the polls. This proposal must not be implemented now but must be done in the future. The same leaders who increased the numbers are now trying to reduce them.

* Re-collection of unpaid taxes is weak Leader of the Democratic Leftist Front Vasudeva Nanayakkara

1. We must calculate state revenue correctly first. According to my calculations, it must be higher than mentioned. Attempts to recover taxes from those who haven’t paid are very weak. The tax evaders continue to delay payment through various means. We will not allow lenient policies on tax paying upper classes. We will set up worker councils in all State corporations and enterprises. We will end corruption and increase revenue. The Government is taxing poor people through indirect taxes. This is anti-people. We will reduce indirect taxes and increase the taxable threshold to Rs. 500 000.

2. To reduce State expenditure we must reduce foreign affairs and expenses on diplomatic missions. We cannot maintain these services. Next the expenditure of the Cabinet, President and Prime Minister must be slashed. They obtain more funds through the budget than is estimated as emergency funds. This must be stopped. We have no intention to reduce State sector employee numbers or curtail the Samurdhi benefit.

3. We will put off paying foreign debt by 5 years. We will not seek IMF support. We will come to agreements with other friendly nations for emergency loans.

4. This is not a significant saving. There is more to be done. Expenditure of the Road Development Authority, Water Board for example can be reduced. But we do not oppose the reduction of LG Councillors. But the Cabinet must be slashed before that. What we need is an efficient Government operations department and procurement department. Local industries must be developed.

* Taxes will not be the main Government revenue General Secretary Janatha Vimukthi Peramuna Tilvin Silva

1. Our State expenditure has been more than our revenue for around 30 - 40 years caused by the loss of production revenue. New industries were not developed leading to a decrease in Government revenue. The Government must increase its revenue through the increase of production and the people’s revenue. Our policy will be to set up a production based economy and cut unnecessary State expenditures. Taxes will be bearable and not the main revenue of the state under our Government.

2. Past governments increased Government employees causing a crisis. The leadership must be exemplary in cost cutting but for example a thumping amount is being spent on the Independence Day celebrations. Why can’t it be held on a lower scale to set an example? More ministers have also been appointed. Failing to cut costs on your own and asking the people to do so is a fallacy.

3. Debt is not a crime if we increase revenue to pay these loan installments. But we did not do this. Now since we defaulted we cannot obtain any loans. If we plan together with our lenders and show our plans to earn revenue we can come to some agreement. We will formulate a plan on increasing production targeting the international market.

It is Ok to receive IMF support but it is not a panacea to the problems faced by us. Migrant workers are not sending funds to us as they have no trust in the Government. We must make sure any party can trust us.

4. This is a fallacy. It was increased to 8,000 when the current President was in power. This is an attempt to delay polls. We do not mind the number being reduced but it must happen at the next election. Allowances of MPs, President and even Prime Minister must be curtailed.

* Corruption must be eradicated

Samagi Jana Balawegaya MP D. Harsha de Silva

1. Last year, we became the country with the lowest income in the world in terms of GDP. Taxes have not been collected correctly and various frauds have taken place. Tax collection must be more efficient. Some have got tax breaks for 30 - 50 years. Tax breaks must be only for a short period of time. Instead of tax concessions, tax concessions commensurate with investment should be given. If taxes are to be increased, major reforms must be made.

2. Corruption and waste must be stopped to reduce State expenditure. We are wasting a significant amount of funds on national security. We must speak about the real situation of the country.

3. We must accept IMF support. If not we won’t be able to obtain loans from the World Bank or Asian Development Bank for concessionary interest rates. The IMF will create financial discipline in Sri Lanka leading to more trust. Only then will investors trickle in. The people however must accept IMF proposals.

4. We are agreeable to this but it cannot be used as a tactic to delay polls.