Are you a Bonsai enthusiast? or just a viewer simply interested in its aesthetic beauty? Whichever you are, this article does not just explore Bonsai art on the surface but dives into its scientific dimensions.

Successful Bonsai cultivation involves not only horticulture but also plant biology, soil science and environmental science.

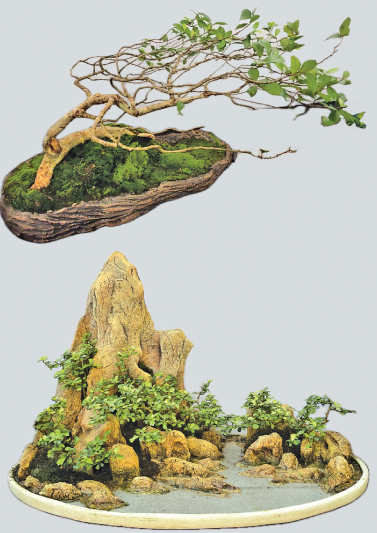

Just like in horticulture, Bonsai requires the pruning and regulation of growth. By trimming branches, roots and leaves, the size of the tree is controlled, and its growth is guided.

Pruning the top

In regular trees, the main trunk grows stronger than the lower branches due to apical dominance. In Bonsai, pruning the top diverts the tree’s energy to the lateral branches, maintaining a balanced growth. Trimming branches and leaves also reduces the overall size of the plant, promoting the desired shape and form.

Root pruning helps to limit the tree’s size while maintaining a healthy root system. Instead of large roots, a fine, smaller root network develops, allowing the tree to thrive in a small pot.

Bonsai trees adapt well to their restricted growth. They exhibit smaller leaves, shorter internodes and compact growth patterns. Understanding these adaptations is crucial to maintaining the health and longevity of Bonsai trees, some of which are preserved for hundreds of years.

Bonsai trees adapt well to their restricted growth. They exhibit smaller leaves, shorter internodes and compact growth patterns. Understanding these adaptations is crucial to maintaining the health and longevity of Bonsai trees, some of which are preserved for hundreds of years.

The growth medium used for Bonsai directly impacts the tree’s health. Based on the principles of soil science, the potting mix ensures nutrient availability, moisture retention, and proper aeration. It is also essential that excess water drains well to avoid root rot. A mix containing components that improve exchange capacity helps the tree absorb nutrients effectively.

Bonsai artists use techniques such as branch bending, leaf reduction and branch binding to shape the tree as desired. These methods promote specific growth patterns. Wiring is a key technique used to position branches correctly, guiding growth without harming the tree. Over time, it enhances the tree’s aged appearance, which would take decades to develop naturally.

Proper watering, manuring and protecting the tree from pests and disease are also critical. Concepts from plant biology, such as photosynthesis and the role of hormones such auxins and gibberellins, are employed to regulate growth and prevent diseases.

Different species

Different species of trees require varying amounts of water and the size of the pot also influences watering needs. Climate plays an important role in this, as it affects evaporation through the plant and soil.

Plant genetics also plays a crucial role in Bonsai. Not all tree species are suitable for Bonsai. Some respond well to pruning, while others do not adapt as easily. Factors such as leaf size, branch growth patterns, trunk shape and root structure are important. Understanding the genetic tendencies of a tree allows for better shaping and artistic results.

Bonsai survival

Environmental science plays a significant role in Bonsai survival, especially in managing the microclimate around the tree. Bonsai trees are typically grown in small pots with limited soil, so light, temperature, and humidity have a major impact on their health. Replicating the native environmental conditions of a Bonsai species leads to the best results. Climatic conditions in regions with distinct seasons particularly influence the growth of these trees.

The balance of nutrients in fertiliser is crucial for Bonsai trees and biological chemistry helps in understanding how to manage nutrient levels and pest control. While some trees are susceptible to fungal infections or pests, preventive treatment such as organic or chemical agents are used. Lime sulfur is often applied to protect the decaying parts of the tree.

Though small, a Bonsai tree acts as a natural air purifier, absorbing carbon dioxide and releasing oxygen. Bonsai can be a wonderful substitute for urban greening, contributing to air quality and overall well-being by bringing a piece of nature into homes and offices.

Bonsai preservation efforts also serve as a living gene bank, protecting species that may face threats in their natural habitats. This is especially important for rare or endangered species that are slow-growing or threatened by environmental pressure.

Relieve mental stress

Working with Bonsai brings you closer to nature and helps improve patience and mental focus. It can also relieve mental stress in today’s fast-paced, consumption-driven society.

Bonsai, or the art of miniature trees, is an ancient craft that beautifully integrates both science and aesthetics. By studying the connection between these two disciplines, one can create more successful and artistic Bonsai designs.

The Sri Lanka Bonsai Association will host the ‘Reflections 2024 – Living Images’ Bonsai exhibition at the J.D.A. Perera Art Gallery of the Visual and Performing Arts University (Horton Place, Colombo 7) on November 9 and 10. The exhibition will be open from 10 a.m. to 6 p.m. on Saturday and Sunday, with special Bonsai creation demonstrations at 3 p.m. on Saturday and 11 a.m. on Sunday.

The Japanese Ambassador in Sri Lanka will be the Chief Guest.