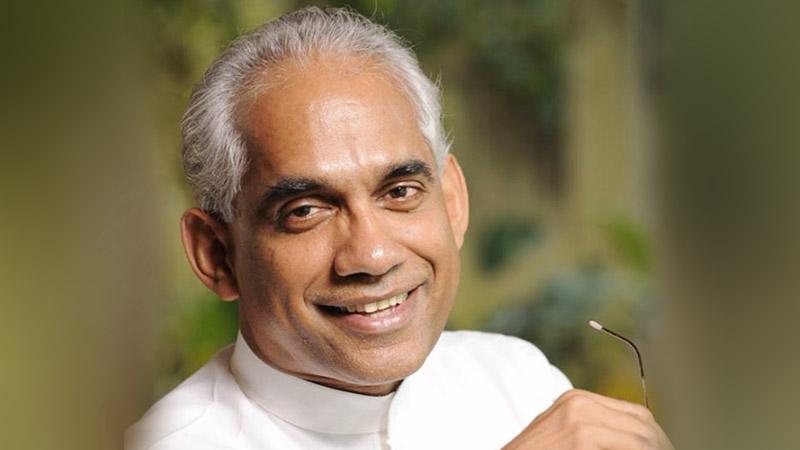

State Minister of Finance and Mass Media, Eran Wickramaratne said last week, that the discrepancy in the debt to GDP statistics has arisen because of several flawed Cabinet decisions taken by former President Mahinda Rajapaksa, to shift loans of certain Public Enterprises out of the government’s financial records and place them into the record books of relevant entities.

Speaking in Parliament last week, Minister Wickramaratne said as Cabinet approval was granted between 2010 and 2013 for these decisions taken by former President Rajapaksa, in his capacity as the then Finance Minister, the Finance Ministry was compelled to adopt this cabinet-approved procedure for the computation of debt in the succeeding years.

While the Annual Reports of the Ministry of Finance and Mass Media and the Central Bank of Sri Lanka indicate a debt to GDP ratio at the end of 2017 as 77.6% (based on an outstanding debt figure of Rs.10.313 trillion at end 2017), the Auditor General’s report on Government Accounts for 2017 denote a ratio of 80.5% (based on an outstanding debt figure of Rs.10.702 trillion at end 2017).

“The difference in the outstanding debt figures is Rs. 389 million out of which Rs. 330 million was due to eight loan agreements entered into by the previous regime with state-owned entities. They excluded these agreements from the Central Government books through cabinet decisions made between 2010 and 2013,” Wickramaratne pointed out.

Of the eight agreements, Wickramaratne said four agreements were entered into with Sri Lanka Ports Authority for the Hambantota Port, three agreements with Ceylon Electricity Board for the Norochcholai Power Plant and one agreement with Airport and Aviation Services of Sri Lanka for the Mattala Airport.

Accordingly, the previous government had transferred the loan balances of Hambantota Port Project, Mattala Airport, Ceylon Electricity Board and the Airport and Aviation Services Authority from the central government’s financial statement on the assumption that these debts could be repaid by the respective state-owned-enterprises. “The Finance Ministry has not attempted to hide any figures but the previous government had done this in an attempt to understate debt statistics. “I would like to remind the former President and former Central Bank Governor that if the debts of the previous government were not hidden in this fashion, total debts during their tenure would have been higher than what was reported to us then,” charged Wickramaratne. Hence, he noted that the former Central Bank Governor, Cabraal who had alleged that the Government is trying to hide debt statistics may either be suffering from amnesia or is on a deliberate mission to distort facts.

Meanwhile, issuing a clarification, the Ministry of Finance on Friday stated that the remaining difference between officially published outstanding debt balance and Auditor General’s calculation as at end 2017 is mainly due to exclusion of Treasury Bonds issued to two State-owned-Enterprises, namely, Ceylon Petroleum Corporation (CPC) and SriLankan Airlines for settling dues.

“As reported in the Annual Report of the Central Bank of Sri Lanka for 2017 (Statistical Appendix, Table 118), the outstanding debt balance of Rs. 10,313 billion excludes treasury bonds issued to CPC in January 2012 to settle dues; and to Sri Lankan Airlines in March 2013 for capitalisation purposes, which in total amounts to an outstanding balance of Rs. 69.8 billion as at end 2017. Any remaining marginal difference if exists, can be attributable to the net credit to government from banking sector operations,” the release by the Finance Ministry stated.

Therefore, the Finance Ministry noted that as the classification differences in government debt statistics has caused confusion among the general public, corrective measures would be taken in due course.

“It is a pity that Mr. Cabraal as the then Governor of the Central Bank who was privy to this decision, is now trying to manipulate the debt to GDP ratio by citing the public policy of non-inclusion of debt, held by SoEs in the government’s balance sheet. This was a decision taken by the then government in which he was a prominent stakeholder in handling the government’s debt management,” the Ministry pointed out.