Despite the romantic allure of American War of Independence, there is little press given to the massive debt crisis that happened in its immediate aftermath.

To fight the British, a cash-strapped Continental Congress accepted loans from France. After the Revolutionary War ended in 1783, America’s business partners in Europe refused to extend lines of credit to the colonies and insisted they pay in hard currency. It was difficult to tax the colonies as they operated as a loose confederation and there was no centralised Government to do so at the time.

Hard cash

The insistence of European businesses for hard cash led merchants to demand the same from their customers in the colonies. The American states was a agrarian economy in the late 18th Century and the rural farming population were unable to meet the demands of merchants and civil authorities while some started to lose their lands and possessions when they couldn’t pay their taxes and debts. To add to this quagmire, many of the veterans who fought in the Independence War were also severely in debt and some were thrown debtors prisons. Deeming this taxation unfair, the colonists took up arms against the State governments.

The insistence of European businesses for hard cash led merchants to demand the same from their customers in the colonies. The American states was a agrarian economy in the late 18th Century and the rural farming population were unable to meet the demands of merchants and civil authorities while some started to lose their lands and possessions when they couldn’t pay their taxes and debts. To add to this quagmire, many of the veterans who fought in the Independence War were also severely in debt and some were thrown debtors prisons. Deeming this taxation unfair, the colonists took up arms against the State governments.

After a particular destructive upheaval in Massachusetts during 1786-1787 called the ‘Shay’s Rebellion’ where violent mobs took over town halls and burned several court houses, the weakness in America’s governmental framework was recognised. The debt crisis and its consequences led to a fierce debate regarding a stronger centralised State between Federalists, who argued for, and Anti-Federalists, who argued against. The ‘strong’ Government faction won and in 1790-1791, Alexander Hamilton, America’s first Treasury Secretary, resolved the crisis in one of history’s nation-building successes. Hamilton turned America’s financial wreckage of the 1780’s into prosperity and political coherence in the 1790’s.

After the Covid pandemic triggered a collapse in tourism, leading to a fall in foreign currency income and rising debt levels – a situation made worse by the surge in global commodity prices, exacerbated by Russia’s war in Ukraine., Sri Lanka was broke and beaten after defaulting on its debts in June 2022.

Mass protests

Frustrated by the lack of fuel and other basic commodities, Sri Lankans took to the streets culminating in mass protests that led to the resignation of Government MPs and finally to the ousting of the President. The country is still being kept afloat thanks to the Indian Credit Line and international creditors giving a momentary break while discussions with the IMF are ongoing.

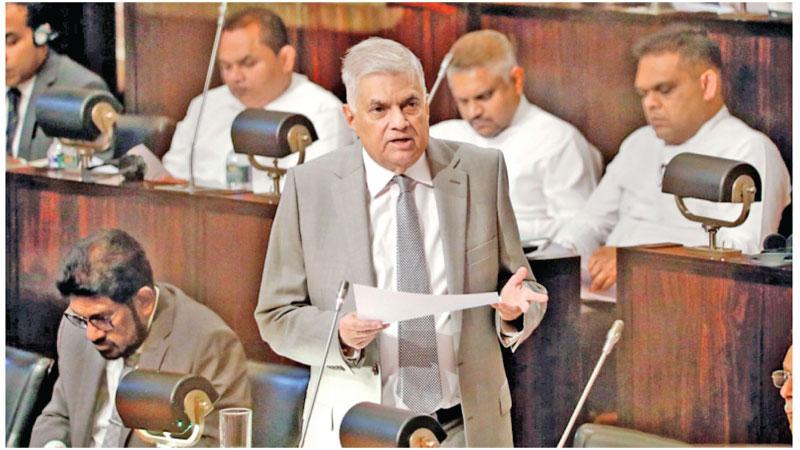

Given this climate, President Ranil Wickremesinghe announced tax changes to boost revenue and make external trade easier in his 2023 Budget. To summarise, the budget proposed phasing out several taxes to be replaced by an updated system in lieu of the current challenges. Though the budget was passed with a majority of 43 votes in Parliament, the budget was not received well by the public.

Austerity follows economic downturn, and Sri Lanka is no exception. Greece for example, defaulted on a debt of EUR 1.6 billion to the IMF in 2015. Greece’s financial crisis was largely the result of structural problems that ignored the loss of tax revenues due to systematic tax evasion and the profligacy of successive Greek governments.

Austerity follows economic downturn, and Sri Lanka is no exception. Greece for example, defaulted on a debt of EUR 1.6 billion to the IMF in 2015. Greece’s financial crisis was largely the result of structural problems that ignored the loss of tax revenues due to systematic tax evasion and the profligacy of successive Greek governments.

We spoke to Prof. Nimal Hennayake, Department of Business Economics, Faculty of Management and Finance, University of Colombo, regarding the Government’s new tax policy. “Any Government in the world cannot function without taxation; you need revenue to meet the state’s expenditure. Sri Lanka has defaulted on its foreign debts, we don’t have enough resources and we don’t have economic freedom. Economic freedom is a must for political stability and these cannot be separated. IMF and other donor countries highlight that Sri Lanka has to come to the position where it was in 2019. In 2019 our tax revenue compared to the GDP was 15 percent”.

Good position

However, he said that tax revenue compared to the GDP dropped by 8.7 percent after a huge tax relief was introduced after the Presidential Election in 2020. “If the ratio of a country’s total tax revenue is seven percent less than 10 percent to the GDP, it is not a good position at all. This is why IMF countries and creditor nations have advised that we should come up to at least the 2019 level”.

Sri Lanka had 1.6 million active tax files in 2019 but this was reduced to 400,000 in 2020. Prof. Hennayake said that Sri Lanka needs financial discipline. “The Government can go after these tax files rather than impose taxes on those getting a payslip. But instead the State is covering up for the lost revenue by taxing people who are earning salaries,” he said.

Prof. Hennayake argued that the tax base should be expanded to increase direct and indirect taxes. “More and more people should come under the tax net. But if the Government tries to do this, there would be a lot of pushback from the public. As you can understand, support for the Government is low these days and you can’t do this without the public’s support”.

Professionals

There are a lot of people who make more money than professionals but don’t pay a single rupee in tax while making use of the State’s infrastructure and other services, he said.

There are a lot of difficult decisions to be made; Prof. Hennayake said referring to the many politicians who opposed going to the IMF. “They said the IMF is serving Western interests. That could be a fair point. But if you don’t want to go to the IMF, why don’t you start by having a stable tax policy in the country so we don’t have to keep going to the IMF in the first place?” he said.

There are a lot of difficult decisions to be made; Prof. Hennayake said referring to the many politicians who opposed going to the IMF. “They said the IMF is serving Western interests. That could be a fair point. But if you don’t want to go to the IMF, why don’t you start by having a stable tax policy in the country so we don’t have to keep going to the IMF in the first place?” he said.

We asked Prof. Hennayake for his opinion on the Rs. 100,000 threshold. “According to the new taxes you need to pay Rs. 3,500 if you make more than Rs. 100,000. This is fair. If you go beyond Rs. 200,000, you need to pay Rs. 10,500, as a percentage it is Rs. 5,000. But after the next slabs, if you make Rs. 400,000 you need to pay Rs. 75,000 as tax, the ratio is close to Rs. 25,000. You keep earning more and more, you go up to 36 percent”.

We inquired if there could be a discount after the IMF bailout. If the Government listens to the professionals they can come to a win-win situation, he says. “Paying around 20-18 percent before 2020 was tolerated. At that rate the State collected around 15 percent to the GDP in tax revenue”. Prof. Hennayake said that Sri Lanka could easily revert to that, which would make everyone happy. “So even after the bailout and debt restructuring, I personally believe that this tax should not come down. Otherwise the Government cannot go ahead,” he said.

“People are questioning that their tax money is not working, which is true to a certain extent. If people see that their taxes are working efficiently, it will be easy for the Government to expand the tax base”.

The Chairperson of Women-in-Management, Dr. Sulochana Segera also said that professionals expect the Government to be transparent about what happens to tax money and critiqued how the new taxes have been calculated. “Professionals were never taxed before but are now.

The calculation has an issue because the EPF and ETF are usually paid after the next salary but here the taxes are coming for the salary before the deduction of loans”. She said that this is problematic since many professionals depend on loans and taxing this way puts enormous pressure on their lives.

“Yes, there are taxes in other countries but they go to benefit the people.

Here, the taxes are imposed on professionals and the private sector to sustain the Government sector and politicians, not for the real running of the country. So there is a question of accountability and transparency here”.

We asked for Prof. Hennayake’s thoughts on how much the State can earn with the new tax regime compared to expenditure. “Around 80 percent of taxes go back to society in the form of wages and pension. Say, if you’re charging Rs. 100 as tax, Rs. 80 goes to wages and only Rs. 20 goes to textbooks, medicines and other subsidies, which is dangerous”. He said that Sri Lanka’s direct tax ratio is less than 20 percent of the total tax revenue.

“Out of the total tax revenue, Government collects more than 80 percent from indirect taxes such as VAT; this is why you see the price of goods going up.

Meanwhile, direct tax percentage is less than 20. Instead, income tax component should go up and indirect taxes should go down in parallel. Like I stated before, the tax net should be expanded to do this”.