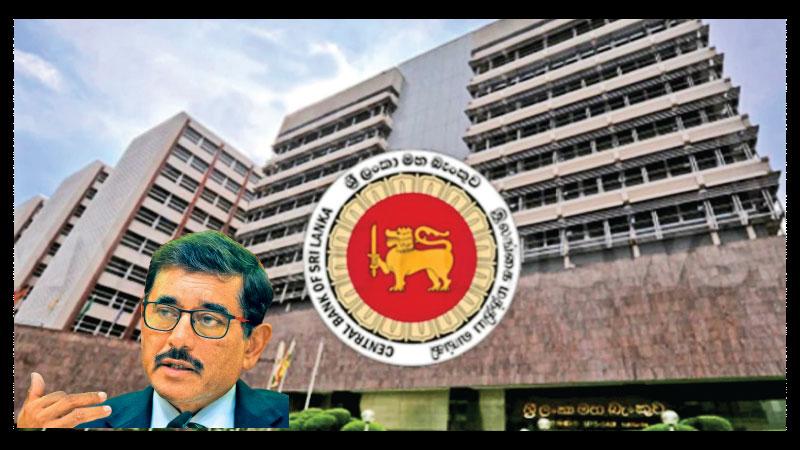

Many criticisms have been levelled against the new Monetary Law Act while others have presented proposals and ideas to be considered prior to its implementation. In a bid to educate the public about the proposed law, Central Bank Governor Dr Nandalal Weerasinghe held a public seminar on March 16 at the Centre for Banking Studies (CBS) in Rajagiriya.

Following are some extracts from Dr. Weerasinghe’s presentation

“The Central Bank of Sri Lanka (CBSL) was established by the Monetary Law Act No. 50 of 1949. An amendment was made to that Act in 2002. In more than 70 years however the Monetary Law Act has not seen any significant amendments. Therefore, the time has come to amend it to bring international recognition in line with the times and new technology. Realising that, the new Central Bank Act was submitted to Parliament in 2019. It has not been adopted and implemented yet.

In such a background, a discourse has emerged on the implementation of the new Central Bank Act. Therefore we as a responsible organisation believe is apt to provide the public with an understanding and knowledge about the Act.

Any act or process cannot remain outdated. According to the needs of the time, the trends that arise from time to time should be taken into consideration and they should be changed. Accordingly, as we all agree, amendments must be made to the Monetary Law Act or a new Bill should be put forward. That is what is taking place today.

The new Act aims to maintain the CBSL as an independent institution. Under the old Act, the CBSL had two main roles. The first was to maintain the country’s economic and price stability on a sustainable basis while the second was to stabilise the financial system.

The CBSL should work to control inflation under price stability. To ensure the stability of the financial system, banks and non-banking financial sectors should work to maintain the safety of deposits and maintain the system without allowing its collapse.

To fulfill these two objectives, the CBSL should be made a more independent and strong institution. Whether the CBSL has been able to achieve these two objectives is debatable. Perhaps it is not wrong to say that we have been successful for the most part. So what should we do? We should work to create a suitable mechanism for that. Accordingly, we must work to achieve and maintain price stability both domestically and abroad. Action should be taken to ensure the safety of the financial system.

It is the CBSL’s job to maintain monetary policy by keeping inflation steady. Implementation of fiscal policy is the role of the Government. These two tasks are different processes. Therefore, it is our responsibility to analyse it without confusing it.

The country’s financial policy is decided by the CBSL, and the public finance policy should be carried out by the Government, which is represented by a Parliament elected by the people. The Government is only one part of the fiscal policy of the country. The biggest creditor of our country is the Government. The second is State-Owned Enterprises (SOEs). The financial policy of the country should become the policy that protects the safety of the depositors.

We must understand this difference. The Government spends taxpayers’ money as Government expenditure. But the CBSL cannot afford to spend depositors’ money like that or let them deplete without providing it with the necessary protection. This is why Government intervention in determining interest and foreign exchange rates must be reduced. The Government should let it be determined based on market demand and supply without undue interference. The new Central Bank Act marks such a start.

Keeping headline inflation in the single digits is prudent. Since 1977, an open market economic system has been implemented in this country. From then until 2009, inflation fluctuated over the years. Its average value was 36 percent. Average inflation has been 12 percent since 2009. It was due to the fact that the CBSL worked to control it through a program aimed at flexible inflation, a method recognised all over the world. Such a program will be strengthened by the new Central Bank Act.

The Sri Lankan economy has suffered a collapse from 2020 because the foreign exchange rate was forcibly kept at Rs.203 against the dollar while keeping interest rates low. This is similar to tying one’s hands. As we have experienced this would cause an economy to collapse. Therefore, accusations that the CBSL has been subject to excessive political interference have been confirmed. Provisions have been made in the new Central Bank Act to eliminate this.

According to the new Central Bank Act, two new boards have been created, the Governing Board and the Monetary Policy Board, in place of the existing Monetary Board.

The Secretary to the Ministry of Finance, who is currently an official member of the Monetary Board, has been removed from it as per the proposed new Act. The Monetary Board currently has five members, led by the Secretary to the Ministry of Finance and the CBSL Governor. The number of members of the Board of Governors and the Monetary Policy Board proposed to be newly constituted is 11.

Instead of the process carried out on the recommendation of the Minister of Finance in appointing members to the Monetary Board, the powers have been expanded to enable Parliament and the Constitutional Council (CC) to appoint qualified professionals and members skilled in many fields including Finance, Technology, and Economics. Accordingly, the new Act has taken the initiative to ensure that the CBSL becomes a more independent and strong institution.

It is the role of an independent Central Bank to control inflation by following a flexible inflation-targeting program according to a world-recognised method and to allow the foreign exchange rate market to operate according to demand and supply.

There is an allegation that the CBSL will be politicised through the new Act. I can assure you that the possibility of this happening has been reduced by the new Act.”

During his speech, the Governor also refuted allegations that the CBSL would fall under the control of external powers. As for who the CBSL will be answerable to following the implementation of the Act, the Governor asked the people to find out who the Supreme Court answers to for their judgements. The activities of Independent Institutions are implemented by their heads with great accountability and responsibility to the people. However, the Act also provides for criminal proceedings to be initiated against anyone who commits an offence under it.

The Sunday Observer also spoke to politicians and several others who had differing viewpoints over the proposed new Act.:

MP Ven. Athuraliye Ratana Thera

“This Act will make Sri Lanka a colony again. This Act stipulates that the work of its Governing Board must be kept confidential. This could be akin to giving powers over financial matters to a private company. It is also dangerous that foreign exchange decisions have been given over to the CBSL. There could be a possibility for CBSL operations to come under hostile forces. This could adversely affect the country’s economic independence and sovereignty. All must oppose this legislation.”

“This Act will make Sri Lanka a colony again. This Act stipulates that the work of its Governing Board must be kept confidential. This could be akin to giving powers over financial matters to a private company. It is also dangerous that foreign exchange decisions have been given over to the CBSL. There could be a possibility for CBSL operations to come under hostile forces. This could adversely affect the country’s economic independence and sovereignty. All must oppose this legislation.”

MP and JHU leader Udaya Gammanpila

“This Act violates the Constitution. We are told that this Act is a condition of the IMF. If the CBSL goes out of the control of the Government, it could be permanent. If there is a discrepancy between the IMF conditions and the Constitution, it is the IMF proposal that should be changed, not the Constitution.

If the CBSL becomes completely independent, it will not be accountable to the people. Then its officials may try to do the bidding of the IMF, embassies and other foreign forces. We have gone to the IMF on 16 previous occasions, but we were never told to make the CBSL completely independent. This condition has not been imposed on any other country. This will make the CBSL dance to the IMF’s tune. We hope the Judiciary will give a fair verdict on this move by the Government.”

Entrepreneur Jihan Hameed

“This proposed Act violates the supremacy of the people. The Central Bank should fall under that. The new Act will also dilute the financial powers of Parliament. The proposed Monetary Policy Board could even have foreign members. This will make the CBSL an institution that is not accountable to the people. But it can act according to IMF dictates. People will then lose their economic sovereignty. It will not be bound to implement fiscal decisions taken by the Government. For example the CBSL might be able to restrict or resist Government fiscal policies with regard to health, education, poverty alleviation, welfare etc. Moreover. The CBSL’s decisions cannot be challenged under the terms of the new Act. This will give rise to monetary policies shaped by foreign agencies and lenders. Monetary units other than the Sri Lanka Rupee could also become legal tender here. This will lead to a colonial setup.”