The Bank of Ceylon (BOC) delivered a strong performance in the first quarter of 2025. Building on the momentum of 2024, the Bank maintained financial stability, demonstrated prudent risk management, and remained aligned with national economic priorities in an evolving macroeconomic environment, a media release from the Bank stated.

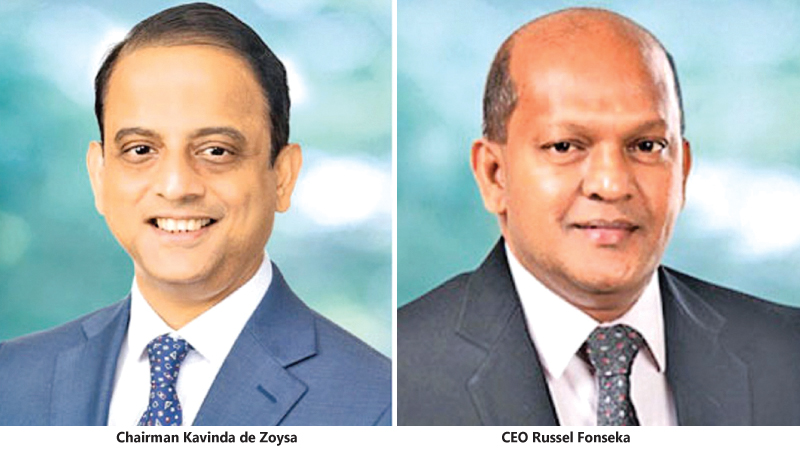

The General Manager / Chief Executive Officer, Russel Fonseka said, “Our financial performance for 1Q 2025, underpinned by a milestone of Rs. 5.3 trillion in total assets, reflects our resilience and unwavering commitment to growth.” In 1Q 2025, the Bank recorded a Profit Before Tax (PBT) of Rs. 30 billion, marking a 222% increase compared to Rs. 9.3 billion in 1Q 2024, driven by robust growth in net interest income and enhanced operational efficiency.

Profit After Tax (PAT) stood at Rs. 17.1 billion, reflecting the Bank’s sustained focus on profitability and prudent cost management. Net interest income (NII) surged to Rs. 50.5 billion, representing a robust 95% year-on-year growth, driven by the Bank’s effective management of assets and liability pricing amid a continued easing in policy rates. While interest income rose moderately by 12% YoY to Rs. 121.1 billion, reflecting the impact of the lower interest rate environment, a sharper 15% reduction in interest expenses to Rs. 70.6 billion significantly enhanced net interest margin.

This substantial improvement in NII underscores the Bank’s strategic agility and sound fund management, enabling it to deliver strong performance despite the prevailing low interest rate regime.

Bank of Ceylon Chairman, Kavinda de Zoysa, said, “As we continue to build on the strong foundation laid by the Bank, our focus remains on advancing our leadership in Sri Lanka’s banking sector. We are committed to delivering exceptional customer service, driving digital transformation, and ensuring prudent risk management and strong governance. “A key priority is supporting small and medium enterprises (SMEs) including women, youth and tech entrepreneurs through careful credit analysis and structuring, innovative digital products and tailored loan solutions, empowering them to thrive in a digital economy. As we look to the future, we are committed to enhancing financial inclusion, expanding our digital offerings, promoting sustainable growth and fostering economic progress. Business revival continues to be a core focus, aimed at supporting both industry and our clients. We will continue to invest in our people to support our ambitious growth agenda for the future,” he said.