Fintech may sound like a buzzword from overseas boardrooms, but in Sri Lanka, it’s taking root with local flavour, one digital wallet, one smartphone, one trust-based transaction at a time.

Here’s how a quiet revolution is brewing beneath the surface of our island economy.

In Sri Lanka, money always had a heartbeat

Remember when a cup of tea and a promise were enough to get credit at your local kadé? We’ve always known how to move money with trust. Long before we used terms such as “financial inclusion” or “micro-credit,” communities across the island were trading, lending, and saving — guided more by relationships than receipts.

But something is changing now. Silently. Seamlessly. Digitally.

Fintech — short for financial technology — is quietly rewriting how we access, use, and think about money. Not with fanfare, but with function. Not to erase our traditions, but to extend them into a connected future.

“In Sri Lanka, money has always moved with trust. Now, it moves with technology too.”

Fintech with a Lankan accent

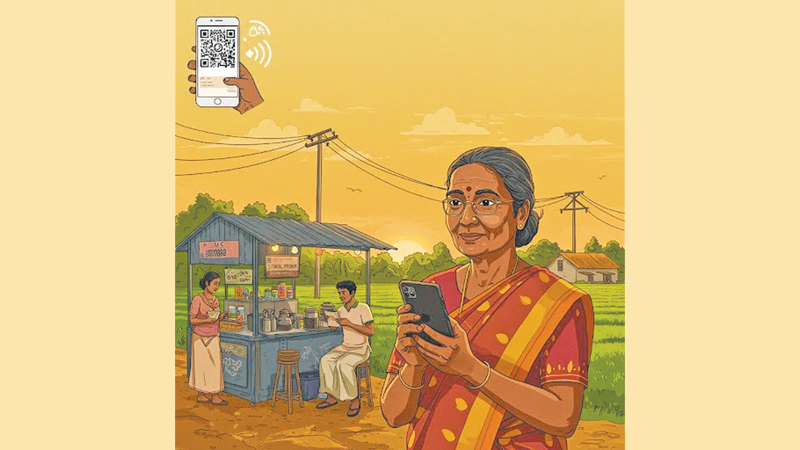

Fintech isn’t merely an urban Colombo affair. It’s a growing movement across all nine provinces, reaching families who never walked into a bank, giving a second wind to small dreams and local businesses. What makes this story uniquely Sri Lankan is how the tech mirrors our values — community, adaptability, and dignity.

Trust used to be handwritten in a red ledger book; now it’s recorded digitally in mobile apps. Credit decisions used to rely on reputation; now they use transparent data, reducing bias and building fairness.

A young designer in Kandy, a retiree in Kurunegala, or a welder in Jaffna they’re no longer excluded from structured finance simply because they lack paperwork. Fintech lets them participate. That’s empowerment.

“Fintech in Sri Lanka isn’t just innovation — it’s inclusion.”

It’s not about apps — it’s about access

The magic of fintech in Sri Lanka isn’t in its complexity. It’s in its simplicity and reach. With more mobile phones than people, the tools for financial empowerment are already in most hands. What was once a banking issue is now a design challenge how do we make it easy, secure, and human?

Whether it’s sending Rs. 500 to your mother instantly, saving for the month ahead, or setting up an online store with digital payments these aren’t mere financial actions. They’re expressions of control. Of planning. Of hope.

Fintech permits daily-wage earners to store income safely, school leavers to budget their expenses, and small businesses to expand without needing to visit a bank branch or fill out intimidating paperwork.

“Your smartphone isn’t just a gadget anymore — it’s a gateway to financial freedom.”

A digital Yal Devi for finance

In many ways, fintech is becoming the digital railway of modern Sri Lanka. Like the Yal Devi connecting the North to the South, fintech is stitching together disconnected communities, one transaction at a time.

It’s reaching the often overlooked estate workers, rural artisans, war widows, single mothers. Not with handouts, but with tools that help them to earn, save, and grow on their own terms.

This isn’t just economic progress. It’s social progress. It’s giving dignity to people whose dreams were often blocked not by lack of effort, but by lack of access.

“From village lanes to virtual wallets, a quiet financial revolution is underway.”

The road ahead

Of course, the journey is just beginning. Challenges such as digital literacy, internet access, and cyber awareness remain. But every step forward every digital wallet opened, every QR payment made, every rupee tracked is a step toward a more inclusive Sri Lanka.

We don’t need to copy fintech models from abroad. We have our own stories, our own solutions, and our own way of doing things. What we need is a uniquely Sri Lankan blend technology built on trust, platforms built with empathy, and systems that recognise every citizen’s potential.

Because at the heart of fintech isn’t technology — it’s people.

“Fintech is becoming our new ‘kadé book’ — but smarter, safer, and open to all.”

A sip of change

So the next time you make a digital payment or help your appachchi check his account balance on a smartphone, know that you’re not merely using a tool. You’re part of a transformation. You’re helping build a Sri Lanka where opportunity isn’t limited by geography, gender, or paperwork but expanded by code, courage, and community.

And like our best cup of tea, this change is brewed slowly, but made to last.

The writer is Head of Marketing at CrossBorder Payments (Pvt) Limited.