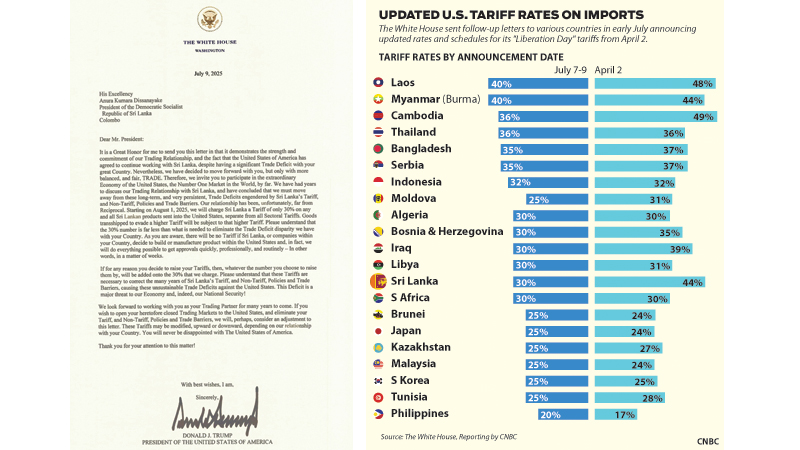

Sri Lanka’s export sector has been jolted by a significant policy shift in Washington D.C. The United States, under President Donald Trump’s recent “reciprocal tariff” framework, has announced a 30 percent levy on all Sri Lankan exports, to take effect on August 1, 2025. This follows earlier threats that tariffs could reach 44 percent, which have now been eased to 30 percent. However, experts and economists say that this move remains a considerable burden for Sri Lankan exporters.

This development unfolds against the backdrop of Sri Lanka’s ongoing economic recovery and efforts to diversify trade routes. The implications for the apparel sector, a mainstay of the national economy, are particularly stark.

This development unfolds against the backdrop of Sri Lanka’s ongoing economic recovery and efforts to diversify trade routes. The implications for the apparel sector, a mainstay of the national economy, are particularly stark.

On Wednesday (9), the White House issued letters to seven countries, including Sri Lanka, confirming 30 percent tariffs on imports.

Senior Economic Advisor to the President Duminda Hulangamuwa told the media that the 30 percent tariff will be in addition to the existing Most-Favored Nation (MFN) duties imposed on all products sent to the US. This move is widely believed to be a reflection on Trump’s wider trade strategy, whereby tariffs are positioned as leverage for securing more “reciprocal” trade arrangements. In Sri Lanka’s case, however, Washington has not identified specific issues in bilateral trade, leaving the tariff as a blunt instrument within a broader geopolitical agenda.

Although the tariff level was initially set at 44 percent in April, it was temporarily delayed and then revised downward to 30 percent in the most recent announcement. Central Bank Governor Dr. Nandalal Weerasinghe said, however, that even at 30 percent the rate exceeds those applying to many competitors.

“We believe that it was out of ‘good faith’ – the fact that we wanted to come to the table to negotiate these tariffs made the U.S. bring down the numbers. We are hopeful that further discussions will result in a favourable outcome for both nations,” said Governor Weerasinghe.

Sri Lanka’s apparel exports to the U.S. have underpinned economic progress and social uplift for decades. The sector employs approximately 300,000 people, predominantly women, and delivered US$ 747 million in sales to the U.S. during the first five months of 2025. In total, apparel accounted for US$ 1.9 billion in U.S. exports in 2024, which is around 40 percent of total apparel revenue.

With deadlines approaching and little time for diplomatic engagement, Sri Lankan exporters fear order cancellations and reduced demand.

A diversified response

In response to the latest tariffs, the Government set up a task force including officials from the Central Bank, Ministry of Finance, and trade agencies to strategise a multi-pronged response. Governor Weerasinghe said that Sri Lanka had already engaged U.S. authorities to reduce the rate. He said that while 30 percent represented an improvement over 44 percent, smaller competitors prefer even lighter burdens.

Secretary to the Ministry of Finance Dr. Harshana Suriyapperuma told the Sunday Observer that plans are under way to target markets in Europe, the Middle East, and Australia, reducing dependency on U.S. buyers. He said that this approach requires investments in compliance, marketing, and brand development which will take a while before coming into fruition.

“It takes a long time for us to explore alternative avenues to counter such risks. But we encourage manufacturers to diversify their markets,” Dr. Suriyapperuma said.

Efforts include subsidies for factories exposed to U.S. tariffs, expansion of duty-drawback schemes for manufacturers, and investment in value-addition and product diversification to reduce over-reliance on traditional textiles.

The International Monetary Fund (IMF), which is monitoring Sri Lanka’s balance-of-payments and economic reforms, has identified external pressures such as tariffs as risks to recovery.

While the apparel sector faces the immediate shock, the tariff has broader ramifications. Key apparel exporters, textile producers, shipping and logistics companies, and ports could all feel the ripples. Export orders may be rerouted or delayed, causing downtime or layoffs in ancillary industries.

The U.S. market accounts for roughly $3 billion in Sri Lankan exports annually. A sudden drop in export volumes will exert downward pressure on the rupee and limit foreign reserves. With nearly 300,000 jobs tied to apparel production, factory closures or downsizing could trigger unemployment, wage loss, and wider social instability, especially amongst women and rural households.

Countries such as Bangladesh and India now enjoy a strategic advantage. Sri Lankan exporters may need to lower prices or offer longer credit terms, compressing profits and investment capacity.

In parallel with tariff mitigation, Sri Lanka is pursuing long-standing trade and investment objectives. Discussions are taking place with the U.S., the European Union, and the UK, aiming to reduce tariffs, streamline customs processes, and secure better market access.

India is seeking tariff relief ahead of the August 1 deadline, while Vietnam benefited from a bilateral deal with the U.S. finalised in April, setting their tariff at 20 percent. Sri Lanka is pursuing a similar path.

Sri Lanka is upgrading customs infrastructure, digital clearance systems, and sanitary standards to meet destination country requirements, which may help offset duties.

Better than the rest?

Efforts are also under way to promote agri-exports (cinnamon, tea, spices), gems and jewellery, and IT and knowledge services which are considered to be sectors less exposed to the new U.S. tariff policy.

Trump’s global plan applies across continents. Besides Sri Lanka, countries such as Algeria, Iraq, Libya, and Bangladesh have been targeted. Rates vary between 20 to 50 percent, reflecting the weight of U.S. imports. For Sri Lanka, the 30 percent rate is unchanged since July 9, despite earlier reductions.

Although tariffs are unilateral, the White House has portrayed letters as de facto agreements, offering relief if nations engage in “negotiation.” Indeed, countries l such as Vietnam, Philippines, and Canada have secured revised rates of 20–35 percent.

The expansion of tariffs on sectors such as steel, autos, aluminium, copper, and now textiles, underscores a protectionist pivot. Messaging focuses on “fairness” and “US competitiveness,” though the effect on consumers and global supply chains may be negative.

To navigate the tariff challenge, Sri Lanka is exploring several avenues. Government negotiators are expected to engage with U.S. trade representatives and Congress, offering market access in other areas or reciprocal concessions. But, Sri Lanka is running against the clock, as the tariffs will take indefinite effect on August 1.

Within SAARC, APEC, and the Commonwealth, Sri Lanka is lobbying against blanket tariffs on small economies and seeking trade assurances. If tariffs breach World Trade Organization’s (WTO) obligations, Sri Lanka could lodge formal challenges. However, WTO dispute resolution is lengthy but measures may arrive after immediate needs are addressed.

Temporary tax breaks and subsidies for exporters, alongside retraining programs for workforce impacted by export slowdown, are also under consideration.

Economists and geopolitical experts said that the new U.S. tariff is a critical test of Sri Lanka’s economic resilience.

With limited lead time and narrow margins, the response must be decisively strategic, balancing urgent mitigation with long term structural reform. Whether Sri Lanka steers towards diplomatic relief or suffers an export contraction will depend on both domestic resolve and global engagement.

Crucially, these tariffs serve as a wake-up call for Sri Lanka. In an increasingly volatile trade environment, economic diversification and nimble diplomacy are not mere options for Sri Lanka. But, rather necessities for survival and growth in the global marketplace.