On a recent family trip from Kalutara to Anuradhapura, Nimal found his long-awaited holiday interrupted in an unexpected way. While passing through Thalawa, he was stopped by traffic police for overtaking by crossing the single white line. It was a Sunday, and the post office was closed.

On a recent family trip from Kalutara to Anuradhapura, Nimal found his long-awaited holiday interrupted in an unexpected way. While passing through Thalawa, he was stopped by traffic police for overtaking by crossing the single white line. It was a Sunday, and the post office was closed.

With no option to settle the fine immediately, Nimal had to return home without his driving licence. A few days later, he had to take a day off from work and endure a gruelling 10-hour round trip back to Thalawa just to pay a Rs. 2,000 fine and collect his licence.

Been there before? Yes, Nimal’s story is just one common example of the time-consuming and inconvenient process the public has been putting up with for decades to pay fines for traffic violations that are not brought to court.

Many who were fined on weekends, public holidays, or outside of normal working hours have had to travel long distances just to make a payment, wasting time, money, and energy on a process that should have been far simpler.

Many who were fined on weekends, public holidays, or outside of normal working hours have had to travel long distances just to make a payment, wasting time, money, and energy on a process that should have been far simpler.

It is no secret that bribing traffic police personnel on duty, or using one’s power, position, or privileged status to avoid all this trouble has become commonplace, openly displaying that some are more equal before the law than others.

The recently-launched Government Digital Payment Platform, branded as “GovPay”, has come up with an online traffic fine payment system as a smarter solution to put an end to this hassle. The platform allows individuals to pay traffic fines online, securely, from anywhere, at any time, simplifying the entire process.

Islandwide rollout in September

Launched as a pilot project in April in selected police divisions, the real-time traffic fine issuance and payment system has already processed over 450 digital transactions, collecting about Rs. 740,000. The pilot project is currently active in Dambulla, Anuradhapura and Kurunegala Highways and 12 Police Divisions in Kurunegala, Mathale and Anuradhapura Districts. These are namely Anuradhapura, Dambulla, Doratiyawa, Galewela, Gokarella, Kawarakkulama, Kekirawa, Kurunegala, Madatugama, Maradankadawala, Melsiripura, and Thirippane Police Divisions.

Information Communication Technology Agency (ICTA) Board Director Harsha Purasinghe told a media conference last week that the online traffic fine payment system would be extended to the whole of Western Province and parts of the Southern Province by the end of July, with an islandwide rollout planned for September. He said all traffic police personnel would be equipped with a smartphone with basic features to implement the system.

ICTA Digital Government and Digital Economy Head Udaya Kasthurirathne said the online payment system has been limited to one payment per day for now, following a request from the Police. This is to prevent the wealthy from taking road rules lightly and repeatedly breaking them, knowing they can easily pay fines online. If someone is caught violating traffic laws again on the same day, they must follow the normal process and pay the fine in person.

GovPay facilitates the online payment of spot fines

“The Police said that the hassle of having to pay the fine physically is part of the punishment itself, and that it has helped discourage many drivers from breaking road rules. In the future, the Police plan to introduce a demerit points system to address the issue,” he told the Sunday Observer.

Traffic Control and Road Safety Division Director Senior Superintendent of Police (SSP) Manoj Ranagala told the Sunday Observer that there are 33 types of traffic offences that can be punished with spot fines. However, serious offences such as driving under the influence of alcohol, driving without a valid licence, or reckless driving cannot be settled with a spot fine and must be reported to court.

“We are working together with GovPay and the Motor Traffic Department to introduce a demerit points system. Each driver will start with a set number of points, and if those points reduce to zero, the driver’s licence will be suspended for six months,” he said.

Some examples of offences that may result in a spot fine include speeding, failing to comply with traffic signals, disobeying the commands and signals of police officers, not taking precautionary measures when parking a vehicle, instructing without an instructor’s licence, excessive emission of noise and smoke from a vehicle, non-use of seat belts, not displaying the revenue licence, using inappropriate signals when driving, and failure to wear protective helmets.

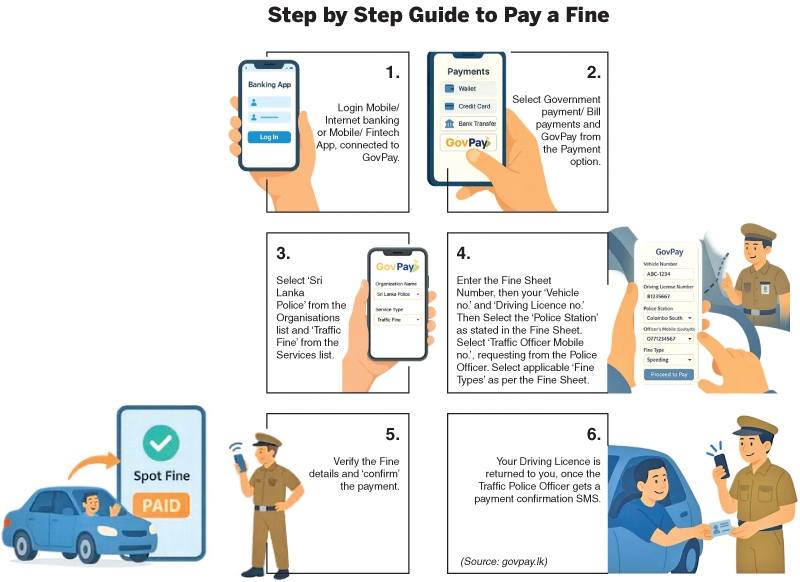

How to use

You can access GovPay through your existing bank’s web or mobile application, so there is no need to download a separate app. Thirteen banks have already partnered with the platform: Amana Bank, Bank of Ceylon (BoC), Cargills Bank, Commercial Bank, DFCC Bank, Hatton National Bank (HNB), National Savings Bank (NSB), NDB Bank, NTB Bank, Pan Asia Bank (PABC), People’s Bank, Sampath Bank, and Seylan Bank.

In addition, six Fintech Apps have also partnered with the initiative. They are namely, CIM, FriMi, Genie, Helakuru, IPay and WEBXPAY.

To navigate to GovPay in your banking or Fintech App, go to ‘Bill Payments’ and select ‘Government Payments’. Then you can fill the required details and make the payment. A nominal convenience fee of Rs. 15 is applicable for transfers. When the payment is successfully made, the police officer on duty will be notified via SMS, after which the licence will be returned to the owner.

It can be observed that finding and proceeding with GovPay for the first time may take a little extra time in some banking apps, depending on the user interface. Therefore, senior citizens and those with low digital literacy may require assistance to use it.

GovPay is actively seeking collaborations with more banks and Fintech solutions to allow more citizens to proceed with payments through the system. It also has plans to launch a dedicated mobile app, and the procurement process for this has already begun. The online traffic spot fine payment system is only one among many features available at GovPay.

One big step for digital economy

GovPay is a collaborative initiative led by the ICTA and LankaPay, the country’s national payment network, and operates under the purview of the Central Bank of Sri Lanka (CBSL). It is an online payment platform designed to facilitate digital transactions for Government services.

GovPay is a collaborative initiative led by the ICTA and LankaPay, the country’s national payment network, and operates under the purview of the Central Bank of Sri Lanka (CBSL). It is an online payment platform designed to facilitate digital transactions for Government services.

Supported by the Digital Economy Ministry, the platform aims to modernise revenue collection processes, ensuring enhanced control, accuracy, security, and transparency in Government financial transactions.

It enables citizens and businesses to securely and conveniently make payments for various Government-related transactions, including taxes, fines, utility bills, educational fees, and other service charges, through banks and digital wallets. Automated payment processing also reduces manual work and paperwork for Government institutions.

No complex backend development or infrastructure changes are required to connect a public institution to GovPay, and no onboarding fee, monthly charges or transaction fees apply for organisations.

“Since its official launch by President Anura Kumara Dissanayake on February 7, the platform has successfully onboarded 52 Government organisations, enabling around 700 active Government services to be paid digitally. GovPay has processed 7,024 transactions, collecting Rs. 65.62 million in Government revenue via seamless, secure digital payments,” said ICTA Board Member Purasinghe.

“Our goal is to onboard 100 plus Government organisations within the next couple of months and drive massive citizen adoption of digital payments across these services. We are aiming for over a billion rupees in transaction value within the next 12 months, contributing meaningfully towards the Government’s ambition of achieving a USD 15 billion digital economy,” he added.

Speaking at the media conference Digital Economy Deputy Minister Eng. Eranga Weeraratne said that transforming the country to a digital economy remains a priority of the Government.

“The GovPay platform contributes to creating a public service free of corruption and bureaucracy. It is one step forward towards a cashless society. Reduced cash handling minimises errors and fraud risks. The often-encountered problem of not receiving the correct balance can be avoided through an efficient digital payment system. We will improve the platform gradually with new features, ensuring that every citizen can securely pay for Government services with ease and convenience,” he said.

Citizens are encouraged to make their Government payments through the GovPay platform via banks or Fintech Apps, where services are now available round the clock.