First Capital Research in their mid-year Outlook for 2022 believes that Sri Lanka is at a tipping point where the current economic situation is expected to gradually improve over the next six to 12 months giving rise to a massive opportunity for investors.

“Sri Lanka’s economy has hit an all-time low with a major struggle for essentials such as fuel, electricity and food. Following the protests, the country went through a change of Government and discussions with the IMF became the key turning point for Sri Lanka,” the report stated.

“With lives normalising and IMF staff level agreement likely to be the start of a new recovery for the country, we expect a resurgence in the economy providing hope and opportunity.”

The introduction of the QR code-based national fuel pass system helped to reduce fuel queues while the gas distribution was normalised. Strong rains improved hydropower generation reducing daily power cuts.

The appointment of a new President and the subsequent improvement in essential services resulted in calming down the protests in the country.

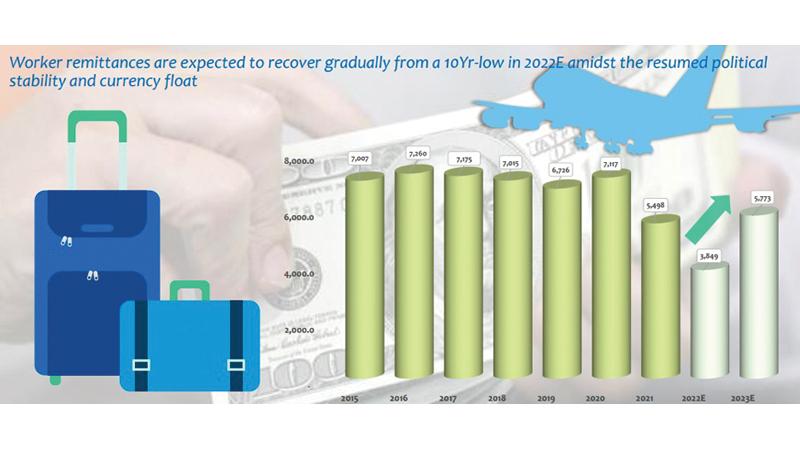

Foreign reserves are expected to reach USD 2 billion by December 2022 while worker remittances and tourism earnings are expected to be major growth drivers of foreign inflows for 2023.

The expectation of a strong recovery in earnings and positive growth levels of GDP returning from 4Q 2023 and beyond, is likely to create a strong bullish sentiment for equities.

“We expect the market to re-rate allowing the index to showcase strong positive returns in 2H in 2023 with the index likely to reach 12,000.”

BOP is expected to improve from 2022E while estimating to register a surplus of USD 1.4 bn in 2023E supported by the strict import controls.

Following the political instability ISBs witnessed a surge in yields while trading at historically low prices. With the restoration of political stability, ISB yields are expected to ease attracting foreign investors to the government securities market.

Fitch Ratings said it may move SL’s Long-Term Foreign-Currency (LTFC) Issuer Default Rating (IDR) out of ‘RD’ (Restricted Default) rating upon the government’s completion of a commercial debt restructuring.

Airing the views on the political side the report said, “With the economic conditions and IMF discussions, most political parties are not willing to go for an election.

But the Opposition believes that the Government should stay in power for a short period until the essential services are established in the country.”

It is estimated to take about 6-12 months to achieve a state of stability following which elections should be held according to the opinion of most political parties. Therefore, elections are unlikely to be held over the next six months.

Discussions are being held with the President to achieve a consensus and form an All-Party Government or working framework. An All-Party Government may improve the policy stability significantly reducing overall risk.”

“If General Elections are held first; it will create a trend for the local government elections as well. However, in the current climate it is doubtful whether any party would secure a sufficient majority to form a government.”