Sri Lanka has a rich history of mining and exporting graphite, which thrived during the World Wars, hitting 35,000 metric tons in annual exports.

The vein graphite produced by Sri Lanka stands out for its purity, flawless crystal structure, and strong electrical conductivity, making it suitable for various commercial uses. However, in 2023, only 2,792 metric tons were exported, yielding approximately USD 6 million in revenue.

The emerging trend towards electromobility on a global scale presents fresh opportunities to revive Sri Lanka’s graphite industry. The newly established Chamber for Mineral Exporters has also emphasised the importance of well-defined policies to harness the untapped potential of the mineral sector.

EV batteries

Graphite forms the core anode material in lithium-ion EV batteries, with quantities varying from 10 kg in hybrids to 70 kg in all-electric vehicles. Consequently, the US Department of Energy classifies graphite as a critical mineral.

Projections indicate global demand for electric vehicles (EVs) will surge to 40 million units by 2030. Consequently, the demand for lithium-ion batteries for EVs has increased and securing sustainable and reliable critical raw materials (CRMs) has become a policy priority. Purity, extraction sustainability, cost, and geopolitical tensions are vital factors impacting the graphite supply chain.

The US industrial and national security policies aim to diversify the sources of CRM for EV batteries - cobalt, nickel, lithium, and graphite - away from China, designated as a “foreign entity of concern” (FEOC).

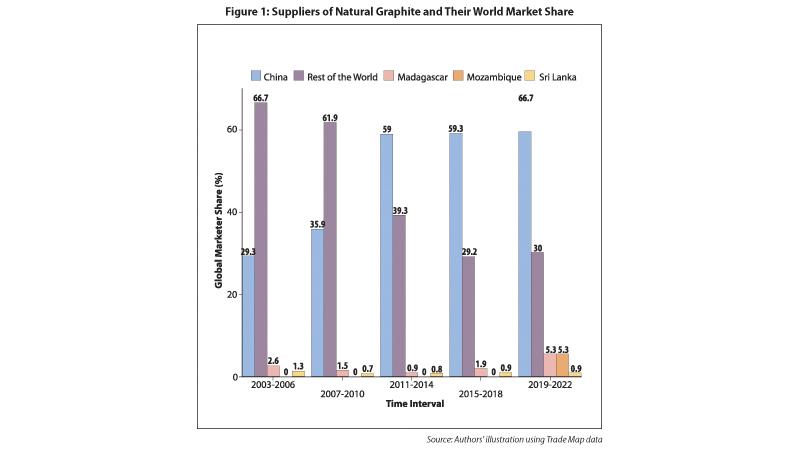

As the primary graphite producer (Figure 1), China possesses 80% of battery-grade graphite resources and controls more than 50% of the processing capacity. More than 65% of the anode material supplied globally was sourced from six companies in China. Crucially, China holds a notable edge in productivity and cost (Table 1), when exporting natural graphite to major economies. Yet, China’s prominent role as the primary graphite exporter has raised concerns about “supply chain resilience” among key Western importers, especially given their geopolitical aspirations.

The Biden Administration’s ambitious Inflation Reduction Act (IRA) has excluded EV batteries that contain graphite of Chinese origin from lucrative federal subsidies.

While this may lead to a relative price increase for EV batteries using Chinese graphite, it also drives up demand for alternatives. Sri Lanka, known for exceptionally high-quality graphite production, could benefit from this shift. With the IRA-induced increase in demand and trade restrictions on China, Sri Lanka’s graphite exports to the US could potentially surge by 65.7% (Table 2).

Global EV battery manufacturing

Sri Lanka’s current graphite production stands at 5,000 metric tons. Yet, according to the Board of Investment, the potential production capacity reaches 450,000 metric tons per year. Given that Sri Lanka is a rare producer of the finest form of natural graphite in an environmentally less harmful manner, the country has an opportunity to tap into the growing global demand for “non-China origin” graphite.

There are several stages of EV battery manufacturing that Sri Lanka may consider joining: exporting natural graphite, exporting processed graphite in the form of electrodes or anodes, exporting lithium-ion cells, and exporting the entire battery pack. For a few reasons, the last two might not be within Sri Lanka’s feasible options.

First, the general organisation of EV manufacturing is that vehicle production plants and battery pack production are located in geographical proximity due to logistic reasons. Second, the US’ renewed tendency to re-shore manufacturing through active industrial policy limits attracting investors to Sri Lanka for producing an entire battery pack or battery cells. Thus, Sri Lanka’s most viable options might be exporting natural graphite or processed electrodes and graphene to the US, Japan, South Korea, and the EU-centred EV manufacturing production network.

Policy recommendations

Sri Lanka should take proactive measures to leverage global policy shifts and identify potential roles within the EV battery value chain. Thoughtfully crafted industrial and trade strategies will play a significant part in maximising the benefits from Sri Lanka’s graphite resources in the emerging landscape.

Sri Lanka’s industrial policy should strive to identify graphite-based products with an existing comparative advantage, link the producers with the end-users, facilitate the acquisition of required technology for value addition, and remove the hurdles for possible mining expansion. Engaging private sector stakeholders in thorough consultations can help Sri Lanka strategically position itself in the competitive EV manufacturing ecosystem. Concurrently, industrial policy must prioritise environmentally sustainable graphite extraction and processing, leveraging Sri Lanka’s potential as a “non-China origin sustainable graphite” source.

A pivotal trade strategy involves forging critical minerals agreements with the US and EU. A pact with the US enables Sri Lanka to process and export value-added graphite, aligned with IRA subsidy rules. A formal accord with major graphite-consuming EV battery manufacturers fosters mining and processing sector investment by eliminating uncertainty.

A burgeoning hub for EV battery production is forming in Thailand and Indonesia, with China, Japan, and South Korea investing in regional EV manufacturing.

Agreements among countries possessing critical mineral deposits are increasingly common, motivating Sri Lanka to broaden its proposed trade deals with Thailand, Indonesia, and other East Asian nations into the EV battery value chain. Trade agreements should facilitate investments in graphite mining and the subsequent processing into electrodes and graphene. – Institute of Policy Studies

(IPS)

Malisha Weerasinghe worked as a Project Intern in the Macro, Trade and Competitiveness Policy Unit at IPS.

Asanka Wijesinghe is a Research Fellow at IPS with research interests in macroeconomic policy, international trade, labour and health economics.