As in the case of Sri Lanka, economic reforms came to India when it was under extraordinary politico-economic stress. Towards the end of the 1980s and early 1990s, terrorism was in full swing in Kashmir. There had been a costly military involvement in Sri Lanka. An aspiring Prime Ministerial candidate, Rajiv Gandhi, had been assassinated by the LTTE. And P.V. Narasimha Rao was heading a minority Government.

Above all, the economy was sinking. India was on the verge of default with a debt burden of US$ 70 billion. The foreign exchange reserve stood at US$ 1.1 billion, sufficient only for two weeks’ imports. The 1990-91 Gulf War had led to a sharp increase in oil prices and a fall in remittances from Indians working overseas. India’s political ally and its major trading partner, the USSR (Soviet Union), was falling apart.

As in Sri Lanka, the crisis was “partly cumulative - the result of years of over-borrowing and anaemic exports,” as the New York Times put it.

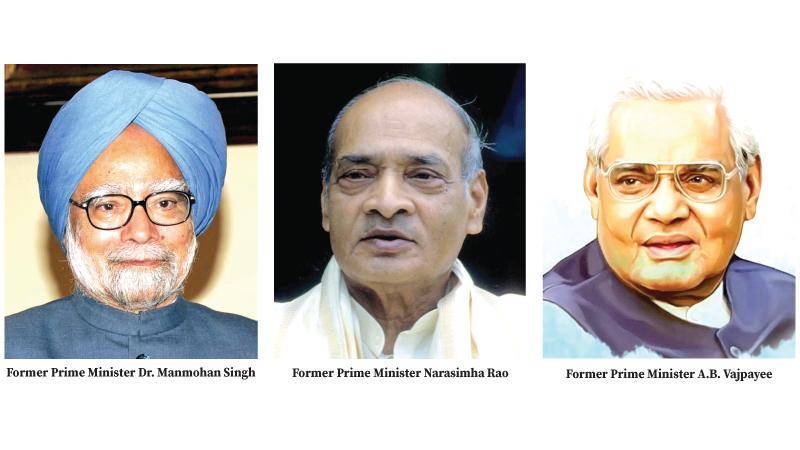

Beleaguered Premier Rao decided to do what was unthinkable in socialistic India – initiate right wing economic reforms. He told his Finance Minister Dr. Manmohan Singh: “We must use this crisis and turn it into an opportunity to do all those things that we should have done before but somehow were prevented by history or other circumstances.” Singh was of the same view.

Acutely aware that modern economic reforms were anathema for all Indian political parties, Rao built bridges with the Leader of the Opposition A.B. Vajpayee of the Bharatiya Janata Party (BJP) who understood the gravity of the situation. Rao cemented his relationship with Vajpayee by sending him to represent India at a United Nations (UN) meeting in Geneva, an unusual gesture in India’s competitive politics.

Reforms, a bitter pill

Though reforms were a bitter pill for many sections of Indian society, Parliament passed the measures without much ado. And eventually, there was popular acceptance as people began to see the benefits of reform. The Congress swept the by-elections held immediately after the reforms began.

Priority was given to preventing a sovereign default. According to economist Montek Singh Ahluwalia (Economic Reforms in India Since 1991: Has Gradualism Worked? Journal of Economic Perspectives, Volume 16, Number 3, 2002), the Rupee was devalued by 9 percent first, and then by 11%, which made Indian exports competitive. The Reserve Bank of India pledged gold holdings with the Bank of England in 1991 raising about US$ 400 million. Earlier, the State Bank of India sold 20 tonnes of gold in May to the Union Bank of Switzerland (UBS) to raise US$ 200 million. The Government had also secured emergency loans from the International Monetary Fund (IMF) totalling US$ 2 billion.

Elaborate structural reforms were carried out, Ahluwalia points out. The infamous “license-permit Raj” was done away with. Its restrictions had stymied economic growth and bred corruption. Industrial licensing for all industries, barring 18, was abolished. Multiple controls over private investment that limited the areas in which private investors were allowed, and determined the scale of operations, the location of new investment and even the technology to be used, were removed.

The Monopolies and Restrictive Trade Practices Act (MRTP Act) was amended to facilitate mergers and amalgamations. The Public sector monopoly in many sectors was ended and automatic approval was given to Foreign Direct Investments (FDI) up to 51 percent of equity. Hundred per cent foreign investment was allowed in some sectors. These changes made it easier to do business in India.

The highly protective trade policy, often providing tailor-made protection to each sector of industry, was modified.

Since fiscal profligacy caused India’s balance of payments crisis in 1991, and a reduction in the fiscal deficit was therefore an urgent priority, the combined fiscal deficit of the Central and State Governments was successfully reduced from 9.4 percent of GDP in 1990 –1991 to 7 percent in 1991–1992 and 1992–1993. According to Ahluwalia, the balance of payments crisis was over by 1993.

Economic growth

Corporate tax rates were increased by 5 percentage points to 45 percent. The Government also increased the prices of LP Gas, fertilisers and petrol and removed the subsidy on sugar. It opened mutual funds to the private sector and relaxed rules for investment by non-residents. A scheme to declare unaccounted wealth was announced with immunity from prosecution.

The economy grew at an impressive 6.7 percent in the first five years after the reforms.

However, according to Ahluwalia, the reforms were half-heartedly carried out and therefore like the Curate’s egg, they were good in parts. India adopted a “gradualist” approach, he said , and added that Indians are unlikely to get the full benefit of reforms.

Here are some deficiencies he lists: Total tax revenues of the Central Government were 9.7% of GDP in 1990 –1991. But they declined to only 8.8 percent in 2000 –2001, whereas they should have increased by at least two percentage points. There was also room to reduce Central Government subsidies, which were highly distorted and poorly targeted. Rational user charges for services such as passenger traffic on the railways, the postal system and university education were not levied. Overstaffing was estimated at 30 percent. Downsizing would have helped reduce expenditure. Agricultural income tax was constitutionally assigned to the States, but no State attempted to tax agricultural income. Land revenue based on landholding was neglected and even abolished in many States.

Urban property taxation could yield much larger resources for municipal Governments if suitably modernized, but this tax base was also not exploited. State Governments suffered large losses as Electricity Boards continued to be in the red.

The same was true of the State Road Transport Corporations.

The accent of the reforms was in the urban-industrial sector to the neglect of the rural and agricultural sectors. School education and health received much less attention than higher education. The banks lent more to the rich and the politically influential than to the common man. High levels of Government borrowing had also crowded out private investment.

A major area where action had been inadequate related to reservation for the small-scale sector. This combined with labour laws restricted this sector’s ability to expand, upgrade technology and provide more employment.

Growth areas

In his critique of the Indian economy Ashoka Mody (see: India is Broken: Why it is hard to fix, Juggernaut Books, New Delhi, 2023) says that growth areas due to reforms were finance, services and construction and not manufacturing which is the one which provides employment. Of the employed only 8 percent were in well-paid jobs with health and pension benefits. Employment has not been an issue for Indian policymakers, according to Mody.

Nearly 60 percent of Indian workers are still in agriculture. Since 1950, the decline has been only by 10 percentage points. Lack of agricultural development has led to poverty and farmer suicides. Rural poverty has led to migration to urban areas but urban India has not been hospitable either.

The Manmohan Singh Government (2004-2014) introduced the National Rural Employment Guarantee Act (NREGA) but the money allotted to it was meagre and the wage was less that the statutory minimum in some States. Throughout this period, the “market mantra reigned supreme and cosy business-politics relationships prospered. The provision of public goods remained a low priority,” Mody writes.

India should have gone in for labour-intensive manufacturing. To keep labour costs low and avoid compliance with labour laws Indian entrepreneurs hired workers on a short term basis. Given the poor wages and easy availability of workers, both workers and employers did not see the need for skills development. This affects both productivity and export competitiveness. The inability to cater to the market leads to an increase in imports. This gives rise to calls for protectionism, which is antithetical to the spirit of reform.