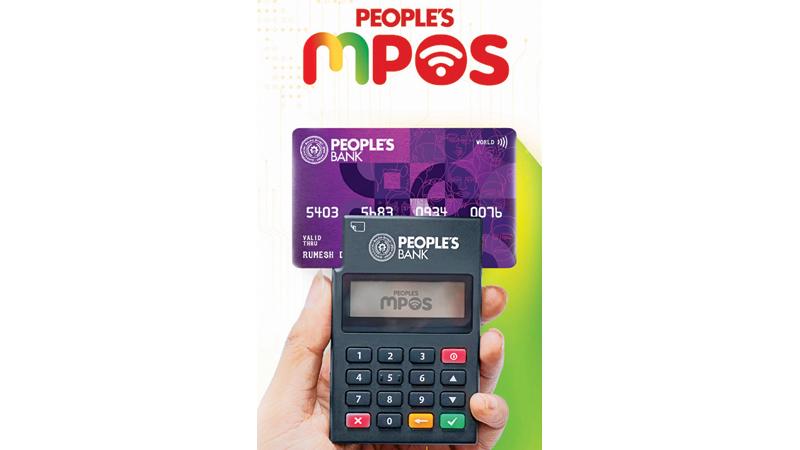

People’s Bank has launched an innovative Mobile Point of Sale (People’s mPOS), to empower small and micro-level businesses to accept card payments on the go.

With the introduction of this cutting-edge technology, merchants can now process transactions using their mPOS device, providing convenience and flexibility to customers.

People’s mPOS solution is designed to cater specifically to the needs of SMEs and micro-level businesses. It enables merchants to accept Visa, MasterCard, and Lanka Pay JCB cards, ensuring a wide range of payment options for customers.

One of the significant advantages of using People’s mPOS is the low discount/commission rate compared to traditional card terminals. Merchants can purchase this payment solution with minimum documentation and hassle. The mPOS solution offers improved mobility and flexibility, enabling merchants to accept payments anywhere and at any time.

The key features of People’s Bank mPOS include a compact and portable device, weighing only 75g and dimensions of 89.7mm x 59 mm x 14.8mm permitting merchants to carry it effortlessly. The device is equipped with a rechargeable battery, ensuring uninterrupted operation. The automatic settlement feature ensures that funds are credited to the merchant’s account on the next working day, streamlining the financial process.

Payable (Pvt) Ltd has partnered with People’s Bank to deliver this groundbreaking technology.

People’s mPOS applications are available at any People’s Bank branch, Card Centre, or can be obtained through the People’s Bank website.