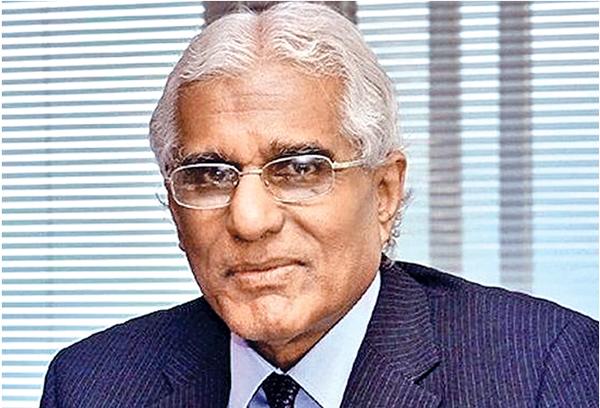

The Governor of the Central Bank Dr. Indrajit Coomaraswamy says although the Monetary Board has scope to consider an interest rate cut in the future due to positive developments in the domestic front, the only reluctance for such a move immediately is due to the international dimension.

He made these comments while speaking to a foreign media channel in Singapore.

He further explained that there are strong arguments in favor of a rate cut as the island’s inflation, credit growth and monetary aggregates have shifted to the desired level while there is also an output gap in the economy.

“Sri Lanka’s domestic conditions are moving in a direction which could create the environment for the monetary board to consider a rate cut. However, the Board at the last meeting wanted to be cautious to make sure the fiscal outcomes for 2017 remains on track,” the governor explained. He pointed out that the Monetary Board at its last Policy Review meeting had considered the fact there is normalisation of interest rates and hence any efforts to reduce the interest rate differential could have led to foreign exchange outflows.

“First we would like to see how the outcomes in the fiscal and then we need to see what is happening in the international economy. Because to compress the interest rate differential at a time when there is increasing uncertainty and volatility could result in outflow of money from our government securities market,” the governor said in an interview with CNBC Television.

Sri Lanka’s headline inflation in February 2018 fell to 4.5 percent from 5.8 percent y-on-y in January as the Colombo Consumer Price Index slipped for the second consecutive month, data released by the Census and Statistics Department of Central Bank last week showed.

Meanwhile, Dr. Coomaraswamy highlighted that Sri Lanka’s achievements in attracting the highest ever Foreign Direct Investments of US $1.63 billion in 2017 and record exports of US$ 11.4 billion in 2017 are indications that the country’s focus in putting in place sound economic fundamentals are beginning to pay off.