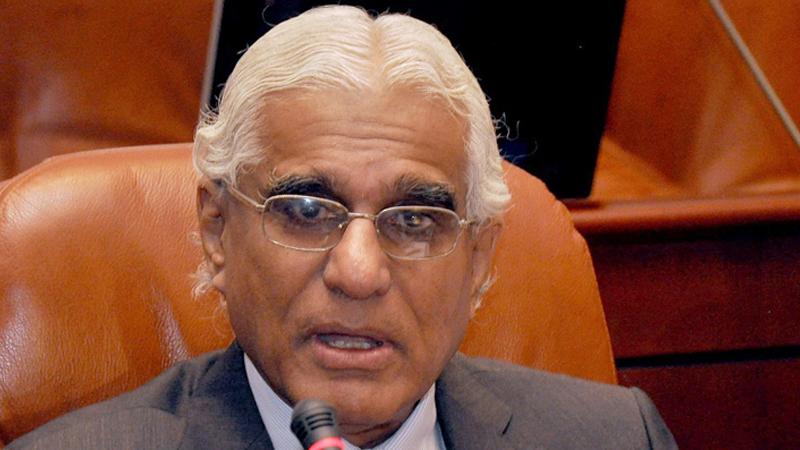

The Central Bank (CB) will go in for more borrowings to meet its commitments this year and in the next, as market conditions are favourable for Sri Lanka and the borrower perceptions about Sri Lanka is positive, said Central Bank Governor Dr. Indrajit Coomaraswamy addressing the third Monetary Policy Review media briefing last week.

He said the Cabinet had approved raising US$ 1.5 billion from international markets for the government’s cash flow needs and another US$ 2 billion separately will be raised to meet debt obligations.

“The Central Bank has received Cabinet approval to raise money under the stipulated limit in accordance with the Appropriation Bill. Perceptions have been good and that’s why markets are opening up for us to raise money,” the Governor said adding that the country has met 65 percent of its external debt obligations.

He said concerns have been raised whether Sri Lanka can meet its debt obligations. “So far we have not gone back on our debt obligations and we are confident we will not renege on them in the future.”

The Japan Bank for International Cooperation (JBIC) and the People’s Bank of China have offered guarantees to us to raise Sakura and Panda Bonds. The World Bank has also offered a policy based guarantee enabling us to borrow up to US$ 1 billion on its AAA ratings. It has agreed to cluster the reforms done by Sri Lanka.

“The approval by the IMF in its fifth review, is a testament to the confidence it has on the country and this will help us to go into the international market to raise money,” the Governor said. With regard to the lead managers of the funds he said decisions were taken in March to continue with the lead managers.

“Certainly there will be a hit on the second quarter growth figures and the year and overall figure. Tourism and a large number of it related sectors have taken a hit. So it is very likely that growth will be below three percent,” the Governor said.

Meanwhile, the Central Bank decided to reduce the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) by 50 basis points to 7.50 per cent and 8.50 per cent taking into account the current and expected developments in the domestic economy and the financial market as well as the global economy. The Bank arrived at the decision to stabilise inflation at mid-single digit levels in the medium term to enable the economy to reach its potential. “We have seen a dovish approach to monetary policy observed by the US Fed and advanced economies due to factors such as increased trade tensions, weakened business confidence and softened external demand and a slowdown in global economic growth,” Dr. Coomaraswamy said.

Several emerging market economies too have relaxed their monetary policy stance to support economic activity, given subdued inflation pressures. Inflation here is expected to remain in the mid single digit level in the medium term.

“There was even a stronger case yesterday (May 30) than in April to reduce rates. With US Fed and advanced economies being dovish, there will be less pressure from external markets. With the global demand slowing down there will be demand contraction. So that’s why we decided to relax policy,” the Governor said on Friday. However, according to the regulator there will be an output gap for some time.

Growth rate slid from 3.4 percent in 2017 to 3.2 percent last year.

“In April, we projected growth to be at around 4.2 percent. However after the Easter events growth is likely to be revised down as the output gap widens,’ the Governor said.

However, the Bank notes that the attacks have affected confidence and sentiments of economic agents, particularly disrupting tourism and related activities. Tourism sector earnings is expected to dip by US$ 1.5 billion triggered by a drop in arrivals by around 30 percent this year. Although normalcy is gradually returning to economic activity, a lower than initially projected growth could be anticipated this year.

The Bank stated that yields on Government securities have also adjusted downward sharply during the year. Driven by the slowdown in private sector credit, the year-on-year growth of broad money (M2b) has also decelerated so far in 2019. Improvements in external sector conditions are observed, particularly in relation to the trade balance.

The improvement in the trade deficit is likely to negate the adverse impact on the current account arising from the slowdown in services exports caused by the contraction in tourism this year.

Responding to the role of the Financial Intelligence Unit (FIU) of the Central Bank in monitoring and taking proactive steps to look into large sums of money coming into local banks prior to the Easter terrorist attacks, the Governor said the FIU had taken all steps to within its mandate. The FIU kept the CID informed of suspicious bank accounts.

On the timing of investing EPF funds in the stock market, he said such investments are made in a professional and transparent manner.